By Michael Race

UK inflation unexpectedly dipped in December for the first time in three months as hotel prices fell and tobacco costs eased.

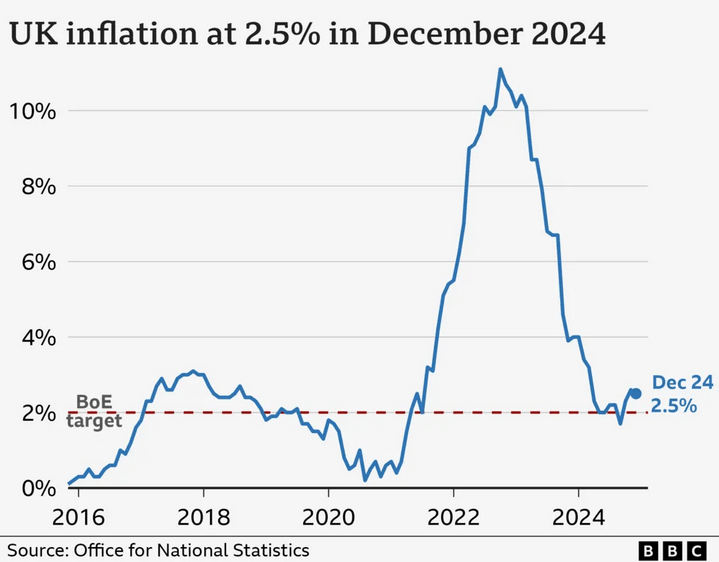

Prices rose 2.5% in the year to December, down from 2.6% the month before, the Office for National Statistics (ONS) said.

Despite the rate of price rises remaining above the Bank of England’s target, expectations of an interest rates cut next month have grown.

The latest figures also ease pressure on Chancellor Rachel Reeves, who has faced criticism following a fall in the value of the pound and government borrowing costs hitting the highest level for several years.

Borrowing costs fell back to last week’s levels and the pound rose slightly to stand at $1.22 as traders reacted to the unexpected inflation drop.

Easing price rises in restaurants, falling hotel prices, and smaller rises in airfares than usual last month helped the overall inflation rate come down, the ONS said.

Prices for tobacco products, which include cigarettes, pouches, vape refills and cigars, also increased at a slower pace.

But Grant Fitzner, chief economist of the ONS, said this was offset by the rising cost of fuel and second-hand cars.

Inflation is much lower than its peak in October 2022 when prices soared, pushing up the cost of living for households and leading to higher interest rates, which has made the cost of loans, credit cards and mortgages, more expensive.

Economists had expected inflation to remain unchanged last month, so the falling rate will be welcome news for Reeves.

The chancellor said there was “still work to be done to help families across the country with the cost of living”, but added the government had “taken action to protect working people’s payslips from higher taxes” and increased the minimum wage.

But shadow chancellor Mel Stride said economic growth had been “killed stone dead by this government” and called for Reeves to “urgently explain how she will now achieve this”.

n response to turbulence in the markets, it is understood the chancellor will bring forward announcements for Labour’s industrial strategy.

Jane Sydenham, investment director at Rathbones Investment Management, said a weak pound tended to signal a “lack of confidence” in the UK economy.

She told the BBC’s Today programme investors needed to “see some detail” on the UK’s plans. “Are there going to be some tax breaks for certain industries? I think specifics and action is what the market wants to see,” she added.

Rising borrowing costs have a knock-on effect on the government’s tax and spending plans, because it will have to pay more interest to finance its existing debt. That leaves less to spend on public services and investment.

Darren Jones, chief secretary to the Treasury, told the BBC public services would “have to live within their means”.

When pressed on whether that sounded as though cuts were on the way, he replied: “It’s just about prioritisation.”

Source :bbc.com