Cautious Optimism Amid Inflation Pressures and Economic Uncertainty

In a widely anticipated move, the U.S. Federal Reserve announced that it will keep its benchmark interest rates unchanged, signaling a wait-and-see approach as policymakers assess mixed economic signals. The decision comes amid persistent inflationary pressures, slowing job growth, and global uncertainties weighing on financial markets.

Fed Chair Jerome Powell, speaking at a post-meeting press conference, emphasized the importance of data-driven decision-making. “We remain committed to our dual mandate of price stability and maximum employment,” he stated. “While inflation has eased from its peak, it remains elevated. Holding rates steady allows us to better understand the trajectory of economic activity.”

The target federal funds rate will remain between 5.25% and 5.5%, where it has stood since mid-2023. This pause marks the fourth consecutive meeting in which rates have been held steady, suggesting that the Fed may be nearing the end of its tightening cycle. However, Powell stopped short of ruling out future rate hikes, should inflation show signs of reacceleration.

The Fed’s decision reflects a balancing act. On one hand, there are signs of progress: consumer spending has softened slightly, wage growth is moderating, and supply chains have normalized. On the other hand, core inflation remains stubborn, and the housing market is showing signs of renewed strength, driven in part by low inventory and strong demand.

Markets reacted cautiously. The S&P 500 ticked slightly higher, while bond yields dipped in response to Powell’s dovish tone. Analysts interpreted the Fed’s stance as an indication that a rate cut, while not imminent, could be on the table later in the year if inflation continues to moderate and economic growth slows further.

Businesses and consumers alike are watching closely. For many borrowers, especially those with variable-rate debt, stable rates offer short-term relief. However, elevated rates continue to challenge homebuyers, small businesses, and sectors reliant on financing. For savers, meanwhile, higher rates remain a relative boon, providing returns unseen in over a decade.

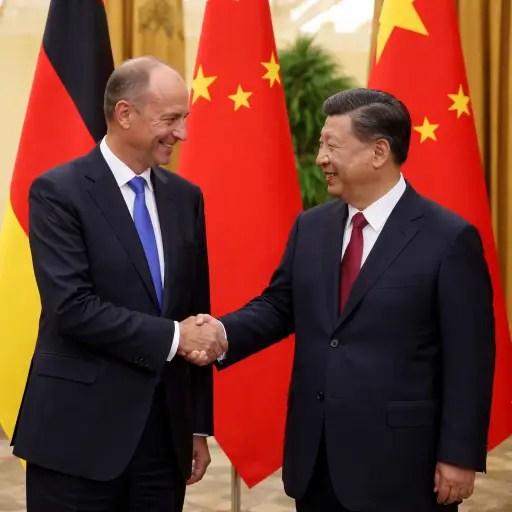

As global central banks chart divergent paths, the Fed’s cautious stance contrasts with more aggressive tightening seen in Europe and some emerging markets. The divergence underscores the complexity of navigating post-pandemic economic recovery, regional shocks, and geopolitical volatility.

In the months ahead, all eyes will remain on inflation data, labor market trends, and broader indicators of economic resilience. For now, the Fed’s decision to hold steady reflects its desire to avoid overcorrecting while maintaining flexibility in an increasingly uncertain landscape.