Debt growth driven by higher interest payments, fiscal stimulus, and structural deficits raises alarms over long-term economic sustainability

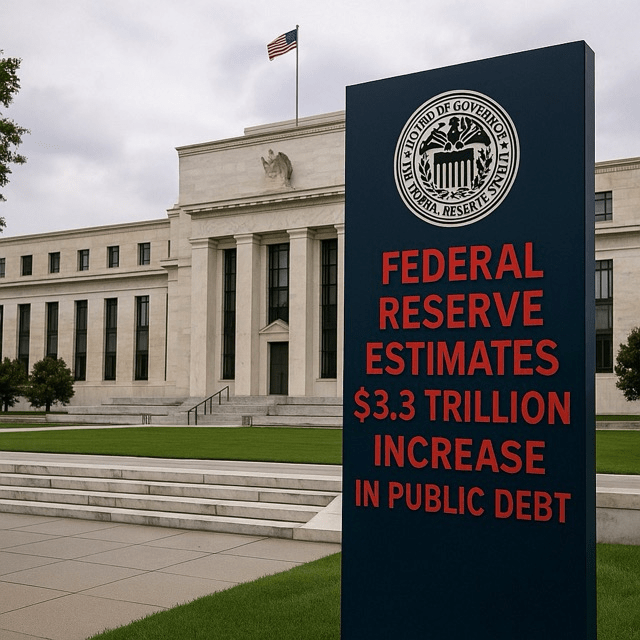

In its latest semiannual financial outlook, the Federal Reserve has projected that the U.S. national debt will increase by an estimated $3.3 trillion by the end of 2025. The projection reflects mounting fiscal pressures from sustained government spending, rising interest payments, and lagging tax revenues amid a complex economic environment.

The report, published on May 20, 2025, highlights the debt surge as a central concern for long-term economic stability. According to Fed analysts, a combination of expansive fiscal policy, ongoing military and foreign aid expenditures, and the structural costs of entitlement programs such as Social Security and Medicare have pushed the federal budget deeper into the red.

‘This level of debt accumulation is not unprecedented, but the pace and persistence are cause for serious policy reflection,’ said Janet Hillman, a senior economist at the Federal Reserve. ‘Without corrective measures, debt-to-GDP ratios could soon reach post-WWII highs, constraining future fiscal flexibility.’

A major contributor to the debt growth is the ballooning cost of interest payments, which now exceed $1 trillion annually. As interest rates remain elevated to curb inflation, the U.S. Treasury faces rising costs to service existing obligations. The report warns that if current trends continue, interest payments could outpace defense spending within the next two years.

Meanwhile, the report notes that recent tax reductions, including temporary credits and stimulus rebates introduced to support households and businesses, have further widened the fiscal gap. Although such policies have provided short-term economic relief, they have also diminished revenue inflows.

Republican lawmakers have pointed to the growing deficit as evidence of irresponsible fiscal policy under the Biden administration, while Democrats argue that investments in infrastructure, education, and climate resilience are necessary for long-term economic competitiveness.

The Congressional Budget Office (CBO) echoed the Fed’s concerns in a separate analysis, projecting that by 2030, the national debt could surpass $45 trillion, barring major legislative changes. This outlook has prompted renewed calls for bipartisan talks on debt reduction, entitlement reform, and tax code modernization.

Wall Street responded cautiously to the Fed’s announcement. Treasury yields ticked slightly upward amid expectations of more frequent debt issuance. Market analysts warn that persistent fiscal imbalances could eventually undermine investor confidence in U.S. government securities.

Despite the warnings, there is little consensus in Washington on how to address the growing debt. Some policymakers advocate for spending cuts, while others call for new revenue sources such as a financial transaction tax or closing corporate loopholes. Still, any major reforms face stiff political resistance in a divided Congress.

‘Debt by itself is not inherently bad,’ noted Nobel Prize-winning economist Paul Krugman in a recent op-ed. ‘But when debt grows faster than the economy, and when interest payments consume an ever-larger share of the budget, the risk of fiscal crowd-out becomes real.’

The Federal Reserve emphasized that while it does not control fiscal policy, it remains committed to monitoring its implications for inflation, interest rates, and financial stability. The central bank also noted that rising public debt could complicate future monetary policy decisions, particularly if inflation were to resurge.

As the 2026 election cycle approaches, the growing national debt is likely to be a key campaign issue. Voters will be watching closely to see which candidates offer credible solutions to one of America’s most pressing economic challenges.