Former president seeks sweeping tax reductions, rekindling economic debates and deficit concerns

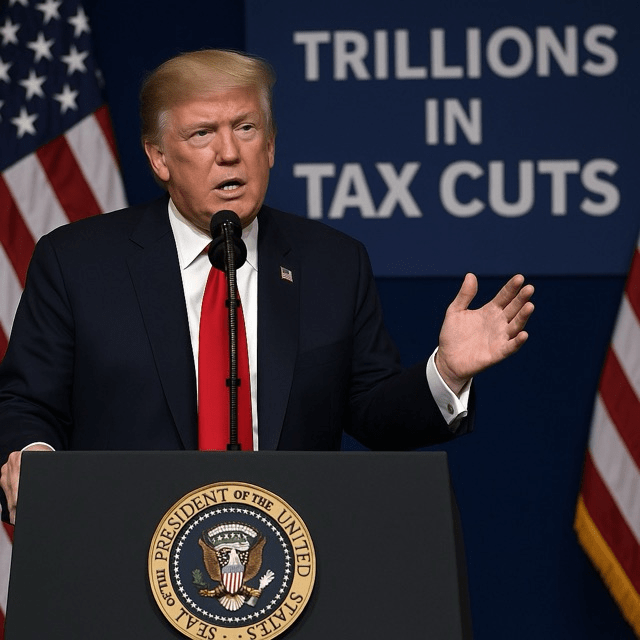

Former President Donald Trump is aggressively lobbying congressional Republicans to pass a sweeping tax cut bill projected to cost several trillion dollars, positioning the move as a cornerstone of his 2025 presidential action. The proposal, which would extend and expand upon the 2017 Tax Cuts and Jobs Act, aims to provide substantial relief for both corporations and high-income earners, while also including modest benefits for middle-class taxpayers.

Trump unveiled the framework describing it as ‘the largest tax cut in American history.’ The plan includes permanent reductions to corporate tax rates, the repeal of the estate tax, and significant lowering of capital gains taxes. It also seeks to reintroduce full expensing for business investments and eliminate various deductions that were capped or phased out in earlier legislation.

Supporters argue the cuts will spur economic growth, attract investment, and return money to American families and businesses at a time when inflation and interest rates remain high. ‘It’s a pro-growth, pro-worker agenda,’ said Steve Scalise, who has been working closely with Trump’s policy team to draft the bill.

However, the plan has already reignited long-standing debates over fiscal responsibility. According to an early estimate from the Congressional Budget Office (CBO), the proposed cuts could add as much as $3.4 trillion to the national deficit over ten years. Economists warn the long-term implications could weaken U.S. fiscal stability, especially as federal interest payments climb to record highs.

Democrats are expected to mount significant resistance in the Senate. Nonetheless, Trump’s allies hope to push the bill through the House by the end of summer, betting that public pressure and campaign momentum can sway key swing-state senators.

In one ad, a narrator says, ‘Donald Trump built the strongest economy in history—he’ll do it again.’

Some GOP lawmakers have expressed private concerns about the bill’s cost, fearing backlash from fiscally conservative voters. Yet few have publicly broken with Trump, whose influence over the party base remains potent. ‘It’s difficult to say no to tax cuts’ said a senior GOP strategist.

Analysts note that while the Trump administration’s 2017 tax cuts contributed to a short-term boost in corporate earnings and stock prices, they also widened income inequality and failed to deliver sustained wage growth for most workers. Critics argue a repeat of the same strategy will yield similar outcomes without addressing underlying structural issues.

Despite the controversy, momentum is building. The Ways and Means Committee is expected to hold hearings on the bill within weeks.