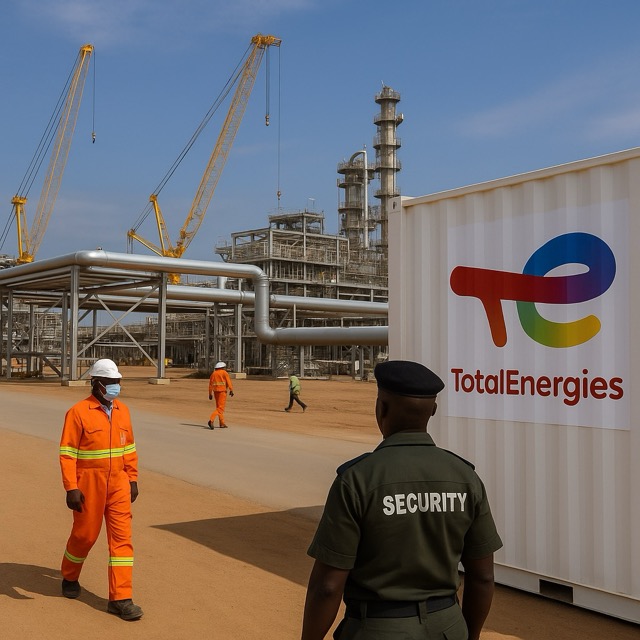

From insurgency‑hit Mozambique LNG to Uganda’s contested EACOP, the French major bets billions that improved security—and geopolitics—will revive its flagship megaprojects.

When Patrick Pouyanné stepped onto the stage of the World Gas Conference in Beijing on 20 May 2025, he surprised investors by announcing that TotalEnergies would “formally seek Mozambique’s approval to lift force majeure” on its US $20 billion liquefied‑natural‑gas project at Afungi. The statement —coming four years after Islamist insurgents overran nearby Palma and forced the evacuation of 8,000 workers — signalled the return of one of the largest energy developments on the planet.

Mozambique LNG: from red zone to restart

Since 2021 the Afungi site has been guarded by Rwandan and Southern African troops. A United Nations report in February noted a 62 % drop in violent incidents within a 40‑kilometre radius of the plant, though sporadic attacks persist in neighbouring districts. TotalEnergies now targets mid‑2025 for construction to resume and 2029 for first cargo, pending renewed loans from US EXIM and Japan’s JBIC. Mitsui, a 20 % partner, says bulk orders for cryogenic modules have been re‑activated with Technip Energies. The project could boost Mozambique’s GDP by 7 percentage points at peak output, according to the IMF.

Tilenga and the East African Crude Oil Pipeline

A second dormant giant is stirring 2,500 kilometres northwest in Uganda. After years of litigation and activist pressure, the US $10 billion East African Crude Oil Pipeline (EACOP) reached financial close on 26 March 2025, securing a first tranche of $2.5 billion from African and Middle‑Eastern lenders. TotalEnergies, which holds 62 %, insists the 1,443‑kilometre heated pipeline will begin pumping by late 2027, fed by the Tilenga and Kingfisher oil fields on the shores of Lake Albert. More than 100 production wells are already drilled, and three rigs will be operating at Tilenga by year‑end, Uganda’s Petroleum Authority reports.

Yet controversy shadows the project. On 23 May the UN Special Rapporteur on Environmental Defenders urged the company to address new allegations of forced evictions and intimidation along the route. Pouyanné retorts that TotalEnergies maintains “zero‑tolerance” for abuses and that independent auditors will publish findings in 2025.

Why revive megaprojects now?

Three forces converge:

1. Security calculus – Cabo Delgado insurgents have been pushed into hinterland pockets; Uganda’s army has secured the pipeline corridor after raids on ADF rebels.

2. Market tightness – Europe’s scramble for non‑Russian gas keeps long‑term LNG prices above $9/MMBtu, making Mozambique LNG attractive despite cost over‑runs.

3. Geopolitical leverage – Paris views African gas as a counterweight to Gulf and US suppliers; Kampala touts EACOP as a path to lower fuel imports and 40,000 local jobs.

Managing the ESG backlash

ESG investors remain sceptical. Germany’s Union Investment ejected TotalEnergies from its sustainable‑fund portfolios over EACOP concerns and called for a human‑rights audit.

Climate groups argue that unlocking 230 million tonnes of CO₂‑equivalent during Tilenga’s lifetime is incompatible with the Paris Agreement. TotalEnergies replies that its Scope‑1 & 2 intensity will fall 40 % by 2030 and that both projects include methane‑capture technology.

Capital discipline — or race to scale?

The dual revival will push TotalEnergies’ capex above US $20 billion in 2026, its highest since 2014. Analysts at Bernstein warn that simultaneous execution stretches engineering capacity; the company is already juggling the Papua LNG pre‑FID and the Qatar North Field South expansion. Pouyanné counters that TotalEnergies “thrives on size‑and‑synergy,” sharing procurement across continents to lock in discounts on pipes and turbines.

Local expectations, global stakes

For Mozambique, first LNG cargo could triple state revenue and fund electricity access for 100,000 households annually. In Uganda, authorities promise the pipeline will turn a landlocked nation into a crude exporter, financing infrastructure and schools. If delays persist, however, both governments risk costly loan repayments without cash flow.

Will the comeback stick?

Experience warns against premature celebration. Insurgents remain active; lenders could back away under activist pressure; and frontier‑market inflation is eroding project contingencies. Yet for now, the cranes are poised to return to Afungi, and pipe sections are being welded outside Hoima. After a half‑decade of false starts, TotalEnergies’ megaprojects appear—cautiously—to be coming back to life.

Sources

Reuters, “TotalEnergies CEO will propose lifting force majeure on Mozambique LNG,” 20 May 2025.

Ecofin Agency, “TotalEnergies plans to restart Mozambique LNG project by August 2025,” 21 May 2025.

EACOP Ltd press release, “First financing tranche closed,” 26 Mar 2025.

UN Special Rapporteur statement on EACOP, 23 May 2025.

Petroleum Authority of Uganda, Tilenga well progress update, 15 Mar 2025.

Bernstein Research note, “Capex pressure at TotalEnergies,” 17 Apr 2025.