Rethinking fiscal frameworks to unlock growth and stability across Europe

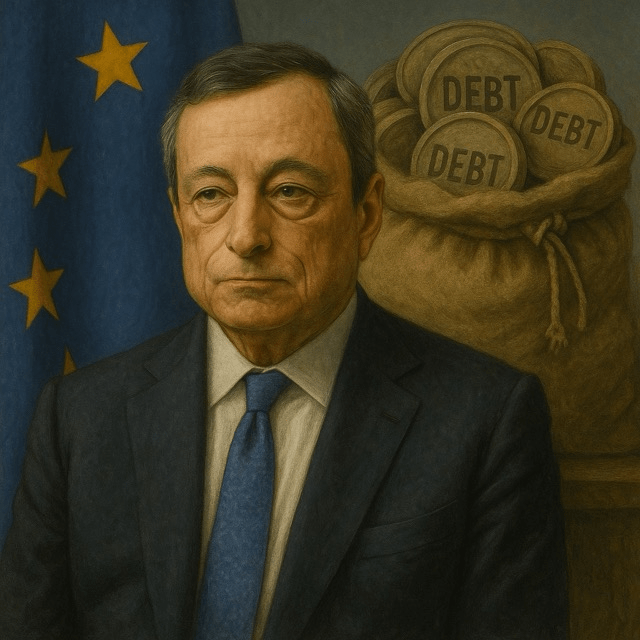

The European Union stands at a pivotal juncture: the legacy of successive crises—from the sovereign debt turmoil of the early 2010s to the COVID-19 pandemic—has burdened member states with unprecedented levels of public debt. Yet, traditional approaches to fiscal consolidation and austerity have yielded only modest growth and recurrent political backlash. In this context, former European Central Bank President Mario Draghi’s proposal for a “Copernican revolution” in debt management offers a transformative alternative: shift the focus from rigid deficit targets to investments that catalyze sustainable growth and resilience across the Union.

At the heart of Draghi’s vision lies the idea of fiscal flexibility underpinned by strong governance safeguards. By permitting member states to deploy targeted borrowing for green transition, digital infrastructure, and strategic autonomy, the EU can break free from the shackles of the Stability and Growth Pact. Such flexibility would be anchored by transparent investment criteria and independent fiscal councils charged with evaluating the long‑term return on public spending. This dual framework ensures accountability while unlocking the financial capacity needed for Europe’s structural transformation.

Critics of expansive fiscal policies argue that high debt levels risk elevating borrowing costs and undermining monetary policy effectiveness. However, the European Central Bank’s long-standing commitment to accommodative monetary conditions—evident in its asset purchase programs and low interest rates—provides a unique window of opportunity. By coordinating fiscal expansion with a supportive monetary stance, the EU can sustain low financing costs while channeling capital into high-multiplier projects. In the medium term, higher growth rates would enhance debt sustainability, lowering debt-to-GDP ratios organically.

A Copernican revolution demands institutional innovation. The creation of a centralized European Debt Agency, as envisioned by Draghi, would standardize borrowing conditions and pool market access for national governments. Through jointly issued “Eurobonds,” the agency could secure financing at favorable rates, mitigating market fragmentation and speculative attacks on vulnerable economies. Crucially, such debt instruments would finance Union-wide priorities, from cross-border rail networks to pan-European research initiatives, thereby generating collective benefits.

Moreover, the EU’s Recovery and Resilience Facility (RRF) serves as a prototype for this new paradigm. By allocating grants and loans tied to structural reforms and green objectives, the RRF demonstrates how conditional finance can drive policy convergence and mutual accountability. Scaling this model into a permanent mechanism would streamline funding processes and reduce bureaucratic overhead. Member states could draw on a shared investment pool, subject to peer review and performance metrics, ensuring that funds yield measurable socio-economic dividends.

Fiscal solidarity does not imply moral hazard but rather reflects Europe’s interconnected destiny. The asymmetric impact of climate change, demographic shifts, and global competition necessitates cooperative solutions. When one member state invests in decarbonization, the resulting emission reductions benefit the entire bloc. When research hubs in Southern Europe attract global talent, the innovation spillovers extend to Northern economies. Recognizing these positive externalities justifies a collective approach to debt-financed investment.

To operationalize the Copernican revolution, the EU must reform its budgetary architecture. The Multiannual Financial Framework (MFF) should be empowered to mobilize financial instruments that complement national spending. A dedicated “Transition Fund” could underwrite large-scale projects—such as hydrogen pipelines and 6G networks—with EU guarantees to de-risk private co-investment. Simultaneously, the EU’s own resources must evolve, tapping into digital taxes, carbon border adjustments, and financial transaction levies to sustain long-term funding streams.

Finally, political buy-in is essential. National leaders and EU institutions must articulate the narrative of shared prosperity, emphasizing that strategic borrowing today secures growth and social cohesion for generations to come. Transparent communication regarding project selection, expected outcomes, and risk management will build public trust. Engaging civil society, regional authorities, and business stakeholders in the decision-making process will further legitimize the shift away from austerity-driven mindsets.

In conclusion, the EU’s future hinges on its ability to embrace a Copernican revolution in debt management, as championed by Mario Draghi. By reconciling fiscal flexibility with robust governance, pooling borrowing through a European Debt Agency, and aligning investments with long-term strategic goals, Europe can transcend the constraints of its past. This paradigm shift promises not only stronger economic performance but also a fortified Union ready to confront the challenges of the 21st century with unity and vision.