Abu Dhabi’s National Oil Company Eyes Major Expansion with Ambitious Offer for Australian Energy Giant

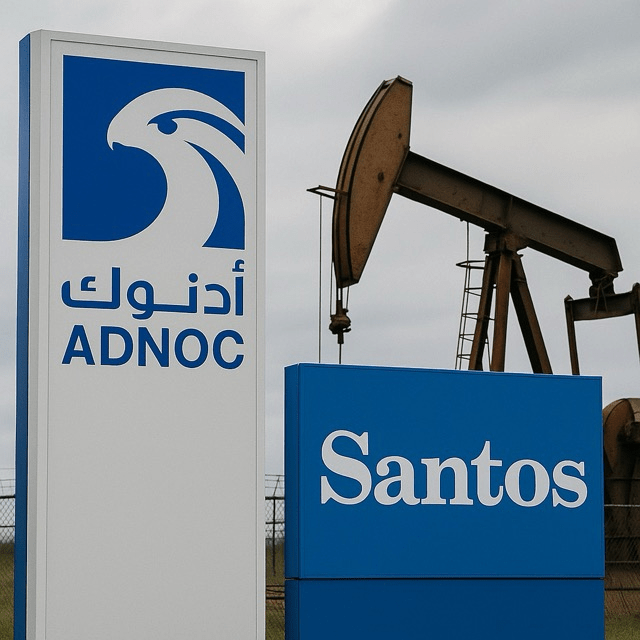

In a move that could significantly reshape the global energy landscape, Abu Dhabi National Oil Company (ADNOC) has made a bold $19 billion takeover bid for Australian oil and gas company Santos Ltd. The proposed acquisition marks one of the most aggressive international expansions by a Middle Eastern oil company into the Asia-Pacific region and signals ADNOC’s growing ambition to become a global energy powerhouse.

### Strategic Rationale Behind the Deal

Santos, headquartered in Adelaide, is one of Australia’s largest independent oil and gas producers, with major assets in liquefied natural gas (LNG), offshore drilling, and domestic energy supply. Its portfolio includes significant stakes in the Barossa gas field, the PNG LNG project, and the Moomba carbon capture and storage facility.

For ADNOC, the acquisition represents an opportunity to diversify its resource base, gain a foothold in a stable, resource-rich economy, and expand its LNG export capabilities in a region that is increasingly central to future energy demand.

With rising global interest in natural gas as a “transition fuel” amid the shift toward cleaner energy, ADNOC sees Santos as a valuable strategic addition to its portfolio. It also reflects ADNOC’s broader plan to internationalize its operations and reduce reliance on Middle East-centric production.

### Political and Regulatory Hurdles

The proposed $19 billion offer is likely to face close scrutiny from Australian regulators. Foreign takeovers in the critical energy sector often trigger national interest reviews, particularly when sovereign-backed entities are involved.

Australia’s Foreign Investment Review Board (FIRB) will assess the deal’s implications for energy security, job protection, and economic sovereignty. Additionally, the acquisition could spark political debate around the influence of state-owned enterprises in national infrastructure.

However, ADNOC has made it clear that it intends to operate Santos with respect to local governance standards, maintaining jobs and honoring existing environmental commitments.

### Market and Industry Reactions

The market response to the takeover bid has been cautiously optimistic. Santos shares rose sharply following the announcement, reflecting investor confidence in a potential premium deal. Analysts suggest that ADNOC’s offer may prompt counterbids from other energy giants, particularly those seeking strategic expansion in LNG or Australian assets.

Industry insiders believe this could trigger a new wave of consolidation in the global oil and gas sector, as companies reposition themselves in the face of energy transition pressures and geopolitical uncertainties.

If successful, the ADNOC-Santos merger would create a formidable entity with influence over critical supply routes between the Middle East and Asia-Pacific, particularly in the LNG market.

### ADNOC’s Global Strategy

Under the leadership of Dr. Sultan Ahmed Al Jaber, ADNOC has increasingly moved toward global partnerships, IPOs, and diversification. Recent deals with companies in Asia, Europe, and the U.S. reflect a broader ambition to be more agile and competitive in a low-carbon future.

This bid for Santos could also help ADNOC deepen its relationships in the Indo-Pacific region, strengthening ties with Australia, Papua New Guinea, and Asian LNG importers such as Japan, China, and South Korea.

Moreover, ADNOC is positioning itself as not just an oil company, but a comprehensive energy solutions provider—investing in renewables, hydrogen, and carbon capture technologies. Santos’ infrastructure and operational capacity align well with this evolving vision.

### Conclusion

ADNOC’s $19 billion bid for Santos signals a bold shift in energy geopolitics. If approved, the acquisition would significantly alter the competitive landscape in the Asia-Pacific energy market and reinforce ADNOC’s status as a key global player.

As governments and markets weigh the implications, this proposed deal underscores a new era where traditional energy firms are increasingly becoming transnational conglomerates—adapting to a rapidly changing world while still competing for dominance in the core fossil fuel markets.