Analyzing Global Supply, Demand Dynamics, and Geopolitical Risks through 2030

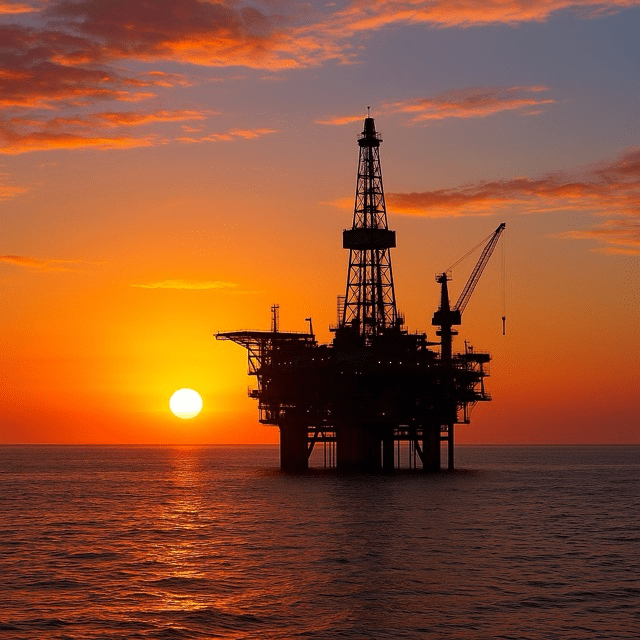

On June 17, 2025, the International Energy Agency (IEA) released its much-anticipated Oil 2025 report, offering a comprehensive medium-term outlook on global oil market fundamentals through 2030. The report arrives against a backdrop of shifting demand patterns, technological transitions in energy systems, and intensifying geopolitical tensions. As policymakers and industry stakeholders dissect its findings, three central themes emerge: a supply glut, plateauing demand growth, and the persistent shadow of political instability.

First, the IEA projects that global oil supply will significantly outstrip demand in 2025. Production is forecast to rise by approximately 1.8 million barrels per day (b/d), reaching 104.9 million b/d, while demand growth is expected to be limited to around 720,000 b/d. This divergence stems from increased output by OPEC+ members rolling back previous cuts and substantial contributions from non-OPEC producers, notably U.S. shale operators, who continue to expand capacity despite lower prices.

Second, demand growth itself appears to be on a decelerating trajectory. After registering growth of 700,000 b/d in both 2025 and 2026, global demand is projected to plateau and eventually edge down by the decade’s end. Key drivers include surging electric vehicle adoption, particularly in China where EV sales are “extraordinary” and oil demand is nearing its peak, and efficiency gains in heavy industries and freight transport.

However, the IEA cautions that these quantitative forecasts rest on assumptions that could be disrupted by external shocks. The report underscores that while current inventory builds—an increase of 93 million barrels in May 2025 alone—signal healthy buffers, they also highlight vulnerability to demand downturns. Should major economies face recessionary pressures, or if EV rollout slows unexpectedly, the oil market could tip further into oversupply, depressing prices and straining producer revenues.

Beyond supply and demand, the IEA’s analysis delves into the evolving nature of strategic risks. In “Amid rising geopolitical strains, oil markets face new uncertainties…”, the agency draws attention to the Israel-Iran conflict and its potential to disrupt Middle East flows, even as current flows remain stable. It also points to emerging threats such as cyber operations targeting refineries and sea logistics, underscoring that market resilience increasingly depends on non-physical forms of vulnerability.

Looking toward 2030, the report’s medium-term outlook paints a picture of a market with ample spare capacity. Global production capacity is expected to grow to 114.7 million b/d by the end of the decade, while peak demand is forecast to hover around 105.5 million b/d. This structural surplus implies sustained low-to-moderate price environments, compelling oil companies to recalibrate investment strategies toward cost optimization and selective high-margin projects.

The report also highlights regional nuances. China, once the primary engine of oil demand growth, is projected to see demand plateau by 2027 as electric vehicles and natural gas liquids supplant traditional fuels. Conversely, demand in North America may enjoy modest growth due to slower EV penetration and resilient petrochemical feedstock requirements. Middle Eastern producers, particularly in the Gulf Cooperation Council, are advised to diversify export routes and bolster infrastructure resilience against potential supply chain shocks.

For policymakers, the IEA’s findings present a dual imperative. Short-term, they must prepare for price volatility stemming from an oversupplied market and potential geopolitical flare-ups. Medium-term, the emphasis shifts to facilitating the energy transition while managing the economic and social impacts of a relegated oil sector. The report recommends enhancing strategic reserves, improving regulatory frameworks for emerging fuels, and fostering international cooperation to mitigate non-traditional risks.

In conclusion, the Oil 2025 report serves as both a mirror and a roadmap. It reflects the current state of abundant production and subdued demand growth, while charting a course through a landscape marked by technological change and geopolitical uncertainty. As stakeholders navigate this slippery slope, the IEA’s analysis provides invaluable guidance on balancing market stability with the imperative of decarbonization.