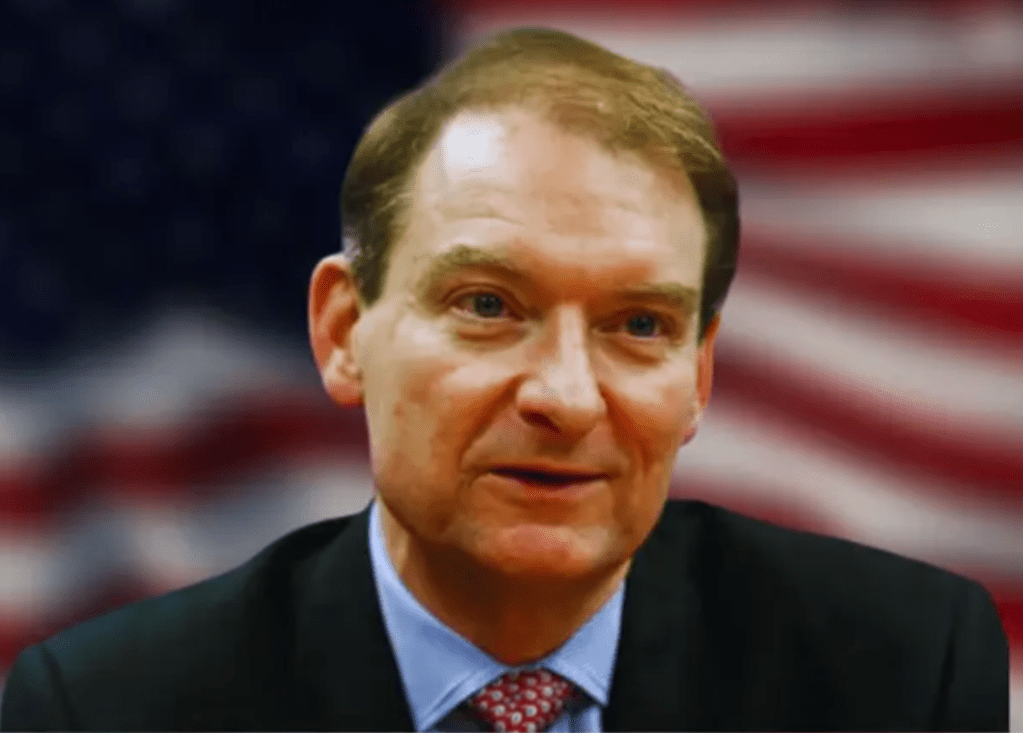

A Profile of the New Chair Steering the U.S. Securities and Exchange Commission

The U.S. Securities and Exchange Commission (SEC) has entered a new chapter with the appointment of Paul Atkins as Chair, a figure known for his deregulatory philosophy and market-oriented approach. As the financial world adapts to shifting regulatory currents, all eyes are on Atkins to see how he will steer the agency tasked with protecting investors and maintaining fair, orderly, and efficient markets.

Atkins, a seasoned veteran in securities law and public service, previously served as an SEC Commissioner from 2002 to 2008. During that time, he earned a reputation for challenging overly burdensome regulations and advocating for policies that encourage capital formation and entrepreneurial growth. His return to the SEC as Chair signals a pivot toward a more conservative, hands-off regulatory stance.

Educated at Wofford College and Vanderbilt University Law School, Atkins began his career in private practice before moving into public service. He has also held key advisory roles, including on the Financial Crisis Inquiry Commission and the President’s Working Group on Financial Markets. Known for his deep understanding of financial markets and his legal acumen, Atkins is widely respected across both political and industry lines.

His appointment comes at a time when the SEC faces growing challenges: digital assets and cryptocurrencies, AI-driven trading platforms, cybersecurity risks, and climate-related financial disclosures. Atkins has emphasized the importance of balancing innovation with investor protection, urging the agency to “avoid regulatory overreach while maintaining integrity in our markets.”

Supporters of Atkins applaud his pragmatic stance. “Paul understands how markets work. He respects the role of regulation but knows when to step back,” said Karen Fields, a policy expert at the American Enterprise Institute. Critics, however, fear that a lighter regulatory touch may expose investors to greater risks, especially in emerging asset classes where transparency is still evolving.

Under his leadership, the SEC is expected to revisit and potentially roll back recent rules deemed excessively complex or burdensome, especially for smaller firms and startups. Atkins is also likely to scrutinize enforcement strategies, favoring targeted actions based on clear evidence rather than broad, high-profile crackdowns.

Despite his deregulatory leanings, Atkins has pledged to prioritize investor education and expand the SEC’s engagement with the public. He has also expressed interest in modernizing the agency’s technological infrastructure to better track market anomalies and fraud in real time.

In his first address as Chair, Atkins outlined a vision of the SEC as “a partner in progress, not an obstacle to innovation.” With global markets evolving rapidly, his leadership will play a pivotal role in shaping the U.S. financial regulatory landscape for years to come.

As stakeholders—from Wall Street to Washington—adjust to this new direction, Paul Atkins’ tenure is set to leave a lasting imprint on the future of American finance.