A Bold Move in Italian Banking as Monte dei Paschi Takes Aim at a Strategic Merger

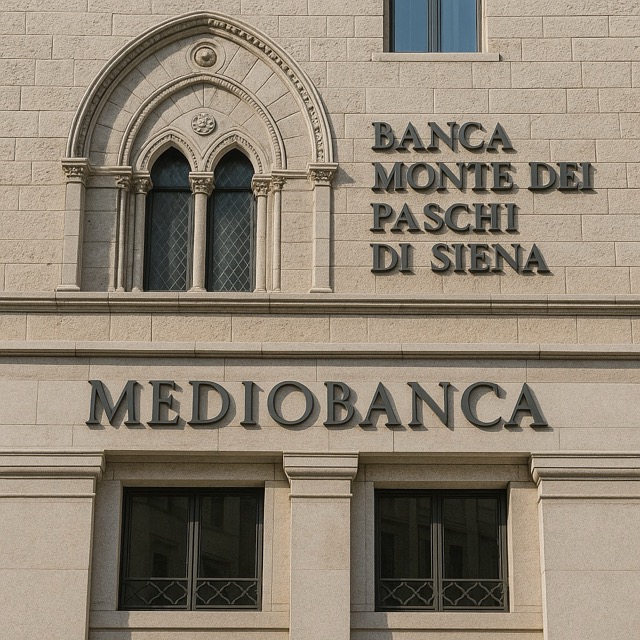

In a significant development for the European banking sector, the European Central Bank (ECB) has granted authorization for Monte dei Paschi di Siena (MPS) to proceed with a public share exchange offer (OPS) for Mediobanca. The decision marks a pivotal moment in Italian finance and could reshape the structure of national banking alliances.

Monte dei Paschi, one of Italy’s oldest and most storied financial institutions, has long been seeking avenues to solidify its market presence and improve its capital structure. The ECB’s green light for the OPS signals institutional support for consolidation in a fragmented banking landscape, where efficiency and scale have become key strategic priorities.

According to sources familiar with the deal, MPS plans to issue new shares to Mediobanca shareholders in exchange for their stakes, effectively merging the two entities under one umbrella. The move is widely seen as a way to boost competitiveness, particularly in investment banking, asset management, and private banking services—sectors where Mediobanca maintains significant expertise.

Analysts suggest that the merger could also create a stronger counterweight to foreign financial groups operating in Italy, offering a more consolidated domestic player with broader capabilities and resilience. The deal, however, will need to win over not only shareholders but also regulatory agencies and financial markets, which remain cautious about potential risks tied to legacy issues at MPS.

MPS has spent the last decade navigating a series of restructuring plans and partial state ownership following a prolonged financial crisis. With this offer, the bank signals its return to a more proactive, strategic phase of growth. In contrast, Mediobanca has traditionally been known for its conservative, stable model and strong corporate governance—a blend that some believe could balance the more volatile legacy of MPS.

The ECB’s role in approving the OPS is critical, as it indicates growing regulatory willingness to support cross-institutional mergers that promise to strengthen the European banking system. Nevertheless, both entities will have to work diligently to integrate operations, align cultures, and realize projected synergies.

Reactions in financial markets were mixed, with MPS shares seeing initial volatility while Mediobanca’s stock experienced a moderate uptick, likely reflecting investor optimism about future growth. Some stakeholders are urging transparency and prudence during the process, emphasizing that long-term success will depend on clear strategic planning and risk management.

If successful, the MPS-Mediobanca merger could serve as a model for other mid-sized banks in Europe, potentially triggering a new wave of consolidation. With increased interest rates and rising competitive pressure from fintech and global banks, such deals may be less about ambition and more about survival.

The coming months will be decisive as shareholders vote, legal frameworks are finalized, and integration plans take shape. For now, the ECB’s approval is a crucial milestone—and a sign that the European banking sector may be entering a new era of bold structural moves.