Battles for Transparency and the Ominous Fall of Generali’s Emblem from Hadid Tower

Over the past decade, Italy’s banking sector has faced a series of upheavals—non‑performing loans, corporate scandals, and shaken public confidence. Yet perhaps no event has captured the nation’s collective unease like the surprising collapse of the Generali sign atop Zaha Hadid’s iconic CityLife Tower in Milan.

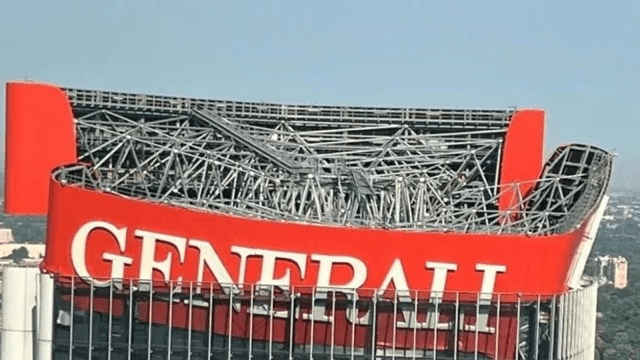

Generali, one of Europe’s largest insurance groups, placed its luminous emblem at the summit of Hadid Tower in early 2024. The sign was intended to symbolize stability and innovation, perched 170 meters above the bustling Piazza Tre Torri. Instead, on a stormy night last November, high winds and structural strain sent the massive letters crashing to the plaza below.

The imagery was jarring: fragments of the red lion logo strewn across the high‑end shopping promenade, just steps from luxury boutiques and freshly landscaped gardens. No one died, but the spectacle reignited scrutiny of Italy’s financial custodians and the underlying vulnerabilities exposed by the crash.

For years, Italian banks have wrestled with the legacy of bad debts—loans extended during the euro‑zone boom that soured during the sovereign debt crisis. Although reforms and recapitalizations have strengthened balance sheets, critics argue that superficial fixes mask deeper governance failures.

In Rome this spring, a parliamentary inquiry laid bare questionable governance at several mid‑sized institutions, culminating in the resignation of two bank CEOs. The hearings revealed close ties between regional politicians and bank boards, leading to preferential lending and conflicts of interest that eroded public trust.

Generali, while not a bank, lies at the heart of this broader financial ecosystem. Insurers underwrite trillions in government and corporate bonds; their solvency is intertwined with the banking sector’s health. The Hadid Tower incident reminded Italians that even the most venerable institutions can be undone by negligence.

Structural engineers now point to design miscalculations in the mounting brackets and underestimation of wind shear at high altitudes. Hadid’s avant‑garde architecture defied traditional forms, but its daring silhouette proved a challenge for conventional installation methods.

The Generali sign debacle has spurred regulators to impose stricter safety audits on corporate signage and high‑rise fittings nationwide. More consequentially, it has galvanized calls for greater transparency in financial disclosures and boardroom decision‑making.

Some analysts believe the tower incident will serve as a metaphor for Italy’s financial fragility: an elegant facade masking internal weaknesses. As European Central Bank stress tests loom next month, Italian lenders will be under pressure to prove their resilience against economic downturns.

In Milan’s financial district, talk has turned to “Hadid‑gate.” Cafés overlooking the tower host heated debates among bankers, lawyers, and architects about whether glamour can coexist with sound engineering—and whether regulatory bodies are up to the task of safeguarding public safety.

Looking ahead, Italy’s financial leaders face a choice: double down on substantive reforms—clean governance, realistic risk assessments, and independent oversight—or risk further jolts that shatter confidence. If the fall of the Generali sign taught one lesson, it is this: when the emblem of stability tumbles, the reverberations are felt far beyond the plaza.