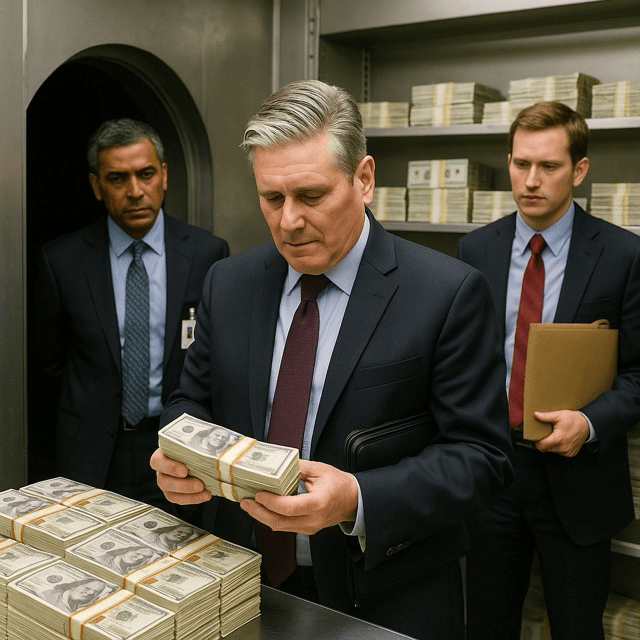

A pivotal moment as court-appointed managers claw back assets stolen in one of the world’s largest financial scandals

In a landmark development for financial accountability, the liquidators of 1Malaysia Development Berhad (1MDB) have announced the recovery of more than $3.5 billion in assets misappropriated from the Malaysian sovereign wealth fund. The funds, siphoned through a complex web of shell companies and offshore accounts, were identified and seized following years of international investigations spearheaded by authorities in the United States, Switzerland, and Malaysia.

Established in 2009 to promote economic development, 1MDB quickly became the epicenter of a global corruption scandal when billions of dollars went missing under the watch of former prime minister Najib Razak. U.S. prosecutors dubbed the case one of the “largest kleptocracy” investigations in history, uncovering extravagant spending on luxury real estate, art, and film productions.

The liquidators, appointed by Malaysia’s High Court in 2018, have systematically worked through court orders to freeze assets worldwide. Key recoveries include a $1.2 billion settlement from U.S. financial giant Goldman Sachs, which underwrote bond issuances for 1MDB, and the repatriation of more than $600 million in assets from Singapore and Luxembourg-based entities.

In a press statement, lead liquidator Richard Chin emphasized the significance of the recoveries: “These funds will be returned to the Malaysian people, restoring faith in the rule of law and setting a deterrent precedent for cross-border financial crime.” Malaysian authorities have earmarked the restored assets for infrastructure projects and debt reduction.

Challenges remain, however. Billions more are still unaccounted for, hidden in obscure trusts and real estate holdings. Liquidators face protracted legal battles in jurisdictions such as the British Virgin Islands and Switzerland, where secrecy laws and legal complexities can delay asset tracing efforts.

International cooperation has been critical. The U.S. Department of Justice’s Kleptocracy Asset Recovery Initiative, alongside Switzerland’s Federal Department of Justice and Police, facilitated the identification of high-value assets, including a private jet and luxury properties in Los Angeles and London.

Domestically, the 1MDB scandal led to sweeping political changes, culminating in Najib Razak’s conviction on corruption charges in 2020. Civil society groups have hailed the asset recovery as vindication of their calls for transparency and good governance.

Proceeds from the liquidated assets will flow into Malaysia’s sovereign wealth fund, which aims to finance public healthcare, education, and sustainable development projects. Analysts predict that the recovered billions could reduce Malaysia’s external debt by up to 15%, easing fiscal pressures exacerbated by the COVID-19 pandemic.

Experts caution that vigilance must continue. “Asset recovery is only part of the solution,” notes forensic accountant Maria Sanchez. “Robust regulatory frameworks and independent oversight are essential to prevent future abuses.” The Malaysian government has since enacted stricter anti-money laundering laws and strengthened its anti-corruption commission.

As liquidators press on with ongoing litigation, the 1MDB saga serves as a stark reminder of the global challenges in tackling kleptocracy. Yet the recovery of billions offers a rare success story in international justice, restoring hope that even the most sophisticated financial crimes can be undone.