As Spain ramps up defence spending, state-backed Indra pivots from radar specialist to Europe’s next defence contender

In recent years, Spain has emerged as a pivotal battleground in Europe’s quest to strengthen its military capabilities. Long criticized within NATO circles for its modest defence budget, Madrid is now charting a course toward transformation. At the heart of this shift sits Indra, the state-backed technology group traditionally known for radar systems and IT solutions. Spanish officials and industry leaders alike view Indra as the linchpin in Europe’s ambition to bolster a “hard power” industrial base capable of rivaling established giants in the United Kingdom and Germany.

Until recently, Spain hovered near the bottom of NATO members in terms of defence spending as a percentage of GDP. Political sensitivities over military engagement and competing domestic priorities have historically constrained Madrid’s investments. However, the war in Ukraine and rising tensions in the Mediterranean have reframed the security debate. With strategic imperatives aligned across the European Union, pressure mounted on Spain to commit more resources, setting the stage for Indra’s defence makeover.

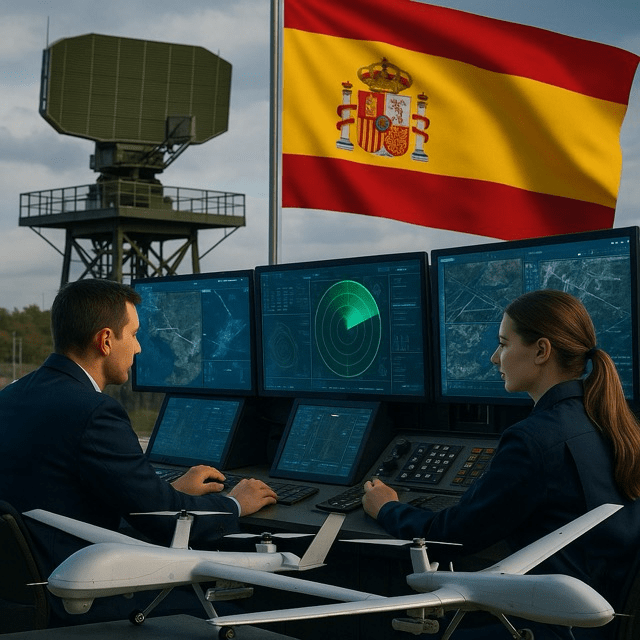

Headquartered in Madrid, Indra has roots stretching back over five decades. The company built its reputation on advanced radar systems, air traffic management software, and IT consulting. While these operations remain profitable, Spain’s government has pushed Indra to diversify aggressively into armaments, cybersecurity, and electronic warfare. Leveraging its technological prowess, Indra is now developing next-generation combat management systems and satellite-based intelligence platforms designed to meet modern defence demands.

Central to Indra’s strategy is a series of high-profile partnerships and acquisitions. In recent months, the company secured joint ventures with European firms specializing in missile guidance and unmanned systems. These alliances aim to bridge capability gaps and accelerate product development. Observers note that by pooling resources, Indra and its partners can discount unit costs and offer more competitive solutions on the global market.

But the challenges are formidable. Indra must contend with entrenched incumbents such as BAE Systems in the UK and Rheinmetall in Germany, both of which benefit from deep product portfolios and established export channels. To carve out market share, Indra will need to demonstrate reliability, interoperability with NATO standards, and lifecycle support. The Spanish Ministry of Defence has signaled strong backing, endorsing domestic procurement and facilitating export licences to non-NATO clients.

Financially, Indra’s pivot necessitates significant capital investment. Upgrading manufacturing facilities, recruiting specialized engineers, and expanding R&D operations will require a sustained funding commitment. Analysts caution that without clear return-on-investment projections, the transition could strain Spain’s public finances. Nevertheless, government officials argue that long-term strategic autonomy—and the prospect of lucrative defence contracts—justify the risk.

Industry insiders point to potential breakthroughs in electronic warfare and cybersecurity as areas where Indra could excel. Spanish universities and research centres have cultivated talent pools adept in these fields, offering a competitive edge. Furthermore, Indra’s existing footprint in Latin America and North Africa provides ready-made channels for technology exports, expanding Spain’s influence beyond Europe’s core defence corridors.

For Brussels, Spain’s renewed commitment serves as a test case for broader EU defence industrial policy. The bloc has struggled to foster cross-border collaboration, hampered by national sensitivities and bureaucratic hurdles. Indra’s success—or failure—will inform future initiatives such as the European Defence Fund and Permanent Structured Cooperation (PESCO) projects aimed at unifying military procurement.

As Indra’s transformation progresses, the world will watch whether Spain can convert rhetoric into robust capability. The coming months will reveal the effectiveness of joint ventures, the market reception of new product lines, and the resilience of political support in Madrid. Should Indra emerge as a credible competitor, it would mark a watershed moment for Europe’s collective hard power.

Ultimately, Spain’s gamble on Indra reflects a broader strategic recalibration. In an era defined by geopolitical rivalries and rapid technological change, European nations are racing to build resilient defence industries. For Spain, success means not only enhancing national security but also staking a claim to the continent’s high-stakes arena of military innovation.