Federal Reserve Chair blames lingering trade tensions for inflationary pressure, limiting monetary policy options

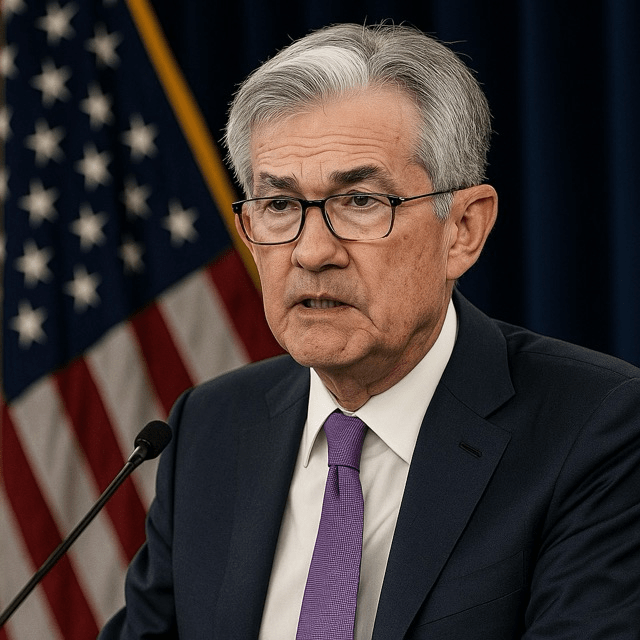

Federal Reserve Chair Jerome Powell has made a striking statement during his latest public address, asserting that the central bank cannot proceed with interest rate cuts due to inflationary pressures stemming in part from tariffs imposed during Donald Trump’s presidency. The comments have reignited political and economic debate over the long-term effects of the former president’s trade war strategy.

Speaking at the Economic Policy Symposium in Washington, Powell emphasized that while inflation has cooled compared to the highs seen in 2022, certain structural forces—especially elevated import prices linked to past trade policy—are preventing the Fed from moving forward with the anticipated monetary easing.

“Tariffs introduced between 2018 and 2020 are still exerting upward pressure on the prices of consumer goods,” Powell noted. “This persistent cost-push inflation limits our ability to responsibly reduce the federal funds rate.”

The Federal Reserve has been walking a tightrope in recent months, balancing the need to support economic growth while ensuring inflation does not rebound. Many analysts had predicted a rate cut later this year, but Powell’s comments appear to dampen those expectations.

The Trump administration’s tariffs targeted a broad range of imports, especially from China, with the stated aim of correcting trade imbalances and reviving U.S. manufacturing. However, critics argue that the levies also led to increased costs for American businesses and consumers. Those effects, according to Powell, are still being felt today.

Economists were quick to weigh in on the implications of Powell’s remarks. “This is a clear message to markets that the Fed is still wary of inflation risks,” said Lydia Harper, senior economist at Greenstone Analytics. “It also highlights how past policy choices can constrain current monetary flexibility.”

Trump, who is once again running for the White House, has defended his trade policies, arguing they were necessary to protect American interests. His campaign issued a brief statement dismissing Powell’s comments as politically motivated: “The Fed is making excuses. The Trump tariffs restored fairness to global trade.”

Yet, the central bank’s position resonates with many financial analysts. Despite improvements in employment and consumer sentiment, the cost of durable goods, electronics, and some imported food items remains stubbornly high. The Fed’s dual mandate—to maintain stable prices and support maximum employment—leaves little room for rate cuts when inflation pressures persist.

Markets reacted cautiously to Powell’s announcement. Wall Street indices dipped slightly in early trading, while bond yields rose in anticipation that borrowing costs will remain elevated longer than previously expected.

Some observers believe Powell is also sending a signal to policymakers in Washington, urging them to consider how fiscal and trade policies influence the central bank’s tools. “The Fed cannot solve inflation alone,” said Dr. Robert Lang, professor of economics at NYU. “Coherence between fiscal and monetary strategies is essential.”

As the 2024 election looms, the intersection of economic policy and political legacy is once again front and center. Powell’s remarks may mark a rare but significant public critique of Trump-era decisions, adding a new layer of complexity to the already charged debate over the U.S. economy’s future direction.