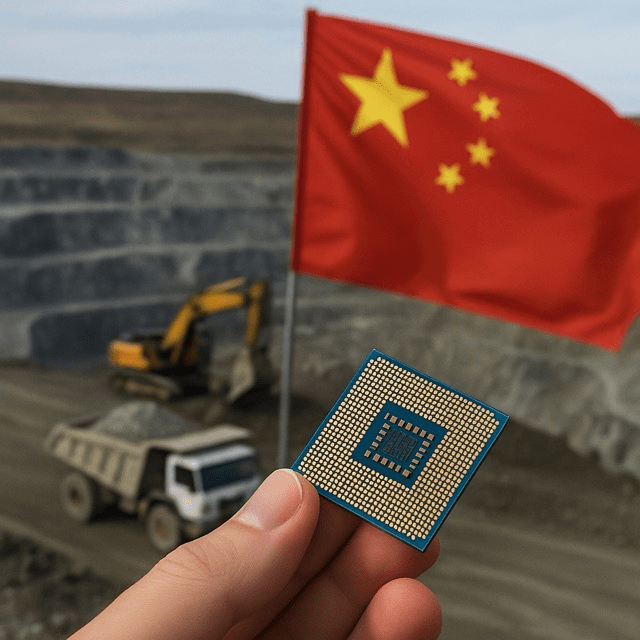

How Beijing’s grip on rare earths is reshaping the global semiconductor landscape

In the escalating global race for technological supremacy, microchips—tiny pieces of silicon etched with billions of transistors—have become the new oil. At the heart of this silent battle lies China, not only a voracious consumer of semiconductors but also the linchpin of a far more strategic asset: critical minerals.

These minerals, such as gallium, germanium, and rare earth elements, are essential for the production of high-performance chips used in everything from smartphones to fighter jets. In recent years, Beijing has asserted increasingly tighter controls over the mining, export, and processing of these materials, causing ripples throughout global supply chains.

Strategic Leverage

While the United States and its allies have sought to restrict China’s access to advanced chipmaking technologies, China has responded by leveraging its dominance over critical minerals. According to the U.S. Geological Survey, China produces over 60% of the world’s rare earths and nearly all of its refined gallium—a vital material for 5G devices and satellite communications.

In July 2023, China imposed export restrictions on gallium and germanium, citing national security concerns. The move, widely seen as retaliatory, sent shockwaves through the semiconductor industry, underscoring the vulnerability of global supply chains.

Global Ramifications

China’s control of these minerals doesn’t only pose a risk to chip manufacturers. It also impacts green energy technologies, military systems, and electric vehicles, all of which depend on rare earths. The geopolitical ramifications are profound: nations are scrambling to secure alternative sources, reviving dormant mines in Australia, the U.S., and Africa, while investing in recycling and substitution technologies.

However, decoupling from China’s supply chain is easier said than done. China’s dominance stems not only from its mineral reserves but from its sophisticated refining capabilities—a segment in which Western nations lag behind.

The Path Forward

To counter China’s leverage, the U.S. and EU have launched initiatives to secure critical mineral supplies. The Inflation Reduction Act and the EU’s Critical Raw Materials Act aim to boost domestic production and processing capacity. Meanwhile, partnerships with resource-rich countries are being pursued under frameworks like the Minerals Security Partnership.

Yet, building resilient supply chains will take time—years, if not decades. In the interim, the semiconductor industry remains entangled in a web of geopolitical tensions, with critical minerals as the pressure points.

Conclusion

The chip war is no longer just about transistors and fabs; it’s about who controls the bedrock materials of modern technology. As the world enters a new phase of techno-geopolitical rivalry, China’s mastery over critical minerals stands as both shield and sword—defending its strategic interests and challenging the technological dominance of the West.