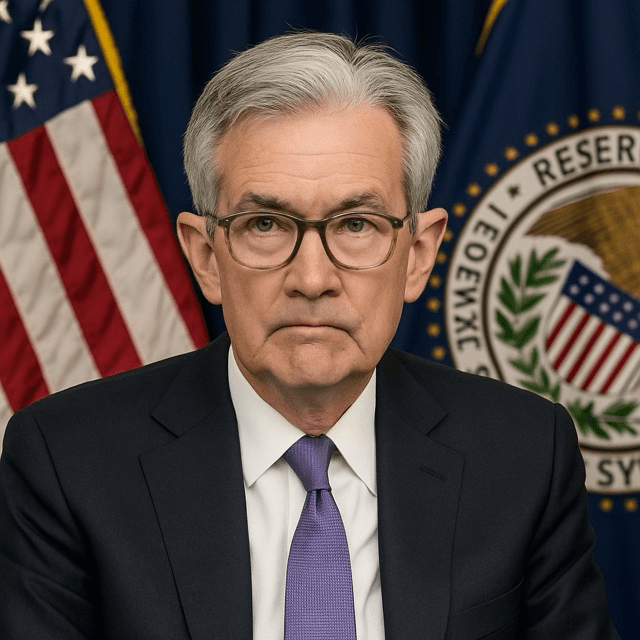

As economic pressures and political tensions rise, Jerome Powell’s tenure tests the limits of central bank independence

Jay Powell and the Tightrope: How Long Can the Fed Chair Stay Above Politics?

As economic pressures and political tensions rise, Jerome Powell’s tenure tests the limits of central bank independence

Washington — Federal Reserve Chair Jerome “Jay” Powell is no stranger to pressure. Since taking the helm of the U.S. central bank in 2018, he has steered the institution through unprecedented economic shocks — a global pandemic, historic inflation, banking tremors, and growing political scrutiny. But with a volatile election season looming and interest rates still a flashpoint, Powell now faces a more existential question: How long can he remain apolitical in an increasingly politicized economy?

Appointed by President Donald Trump and reappointed by President Joe Biden, Powell has become a rare bipartisan survivor in an era of deepening political polarization. His current term runs through February 2026, but recent developments suggest that staying “above politics” might be harder than ever.

Both Republicans and Democrats are casting a closer eye on Powell’s decisions. Progressive lawmakers, including Sen. Elizabeth Warren, have criticized the Fed’s aggressive rate hikes as harmful to workers and housing affordability. Meanwhile, some conservative voices argue the Fed has not done enough to tighten policy and tame inflation. Powell, known for his steady demeanor and cautious communication, has continued to insist that the Fed’s dual mandate — price stability and maximum employment — guides every move.

Still, central bank watchers point out that independence is only as strong as political will allows. “The Fed has operational independence, but it exists within a democratic framework,” says Sarah Binder, a senior fellow at the Brookings Institution. “When the political temperature rises, so does the temptation to politicize monetary policy.”

With inflation showing signs of retreat but growth remaining uneven, Powell has kept rates on hold, awaiting clearer economic signals. But pressure is mounting. In an election year, even the appearance of favoring one side can be damaging. A cut too soon might be framed as helping the incumbent party; a hike could be viewed as sabotaging recovery.

Adding to the tension is the uncertain future of Fed appointments. Should a new administration take office in 2025, Powell could find himself increasingly isolated or even under threat of replacement, despite statutory protections. Historically, only extraordinary misconduct has led to early dismissals of Fed Chairs, but today’s political climate is far from ordinary.

So far, Powell has remained a symbol of institutional resilience. His calm, technocratic style has earned him grudging respect across the aisle. Yet, as political headwinds strengthen, Powell’s balancing act becomes ever more precarious. Can he uphold the Fed’s independence — and his own — for the remainder of his term?

Much will depend on the next 18 months: inflation trends, economic shocks, and, above all, the November 2024 elections. One thing is certain: Jay Powell’s tenure is no longer just about interest rates — it’s about the future of central banking in a democratic society.