Japanese automaker aims to reignite its North American ambitions with new battery platform and next-gen innovation

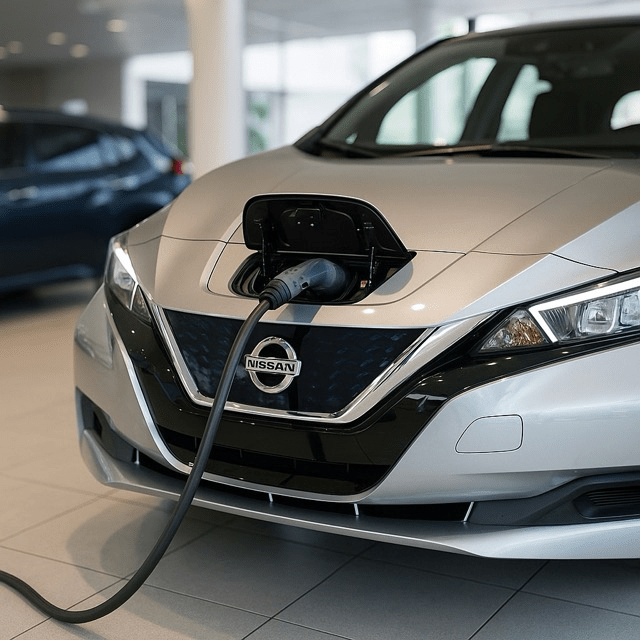

Nissan Banks on Third-Generation EV Tech to Power U.S. Comeback

Japanese automaker aims to reignite its North American ambitions with new battery platform and next-gen innovation

Tokyo — Nissan Motor Co. is preparing for a bold return to form in the U.S. market, betting that the third generation of its electric vehicle (EV) technology will reestablish its credentials as a serious contender in the EV race. The company confirmed plans to launch a new EV platform in the United States next year, built around its latest battery technology and vehicle software architecture.

The move comes at a crucial time for Nissan, which was once a pioneer in the EV space with its Leaf model but has since ceded ground to rivals such as Tesla, Ford, and Hyundai. Now, with demand for EVs surging and competition intensifying, Nissan is positioning its third-generation technology as a leap forward in performance, efficiency, and user experience.

“Our third-generation platform represents a major breakthrough,” said Masashi Okamoto, head of global product strategy at Nissan. “It will deliver faster charging, greater range, and smarter connectivity — features that U.S. consumers are demanding.”

At the heart of the upgrade is Nissan’s new solid-state battery prototype, which the company claims will slash charging times by two-thirds and boost energy density by up to 50%. Paired with a redesigned software system capable of over-the-air updates and AI-enhanced driving assistance, the new platform is intended to rival the most advanced systems on the market.

The U.S. launch — expected in the second half of 2025 — will likely debut with a new electric SUV, produced at Nissan’s revamped Mississippi plant. The company has committed over $500 million to retrofit the facility as part of a broader electrification strategy that aims to make North America a key manufacturing and innovation hub.

Industry analysts are cautiously optimistic. “Nissan has the engineering chops to compete, but this is a critical test,” said Rebecca Hartman, senior analyst at EV Research Group. “If this third-gen tech delivers on range and price, it could give Nissan the edge it’s been missing.”

In recent years, Nissan’s North American market share has slipped, partly due to aging product lines and a sluggish response to shifting consumer preferences. Executives now see electrification as a way to reboot the brand’s identity and appeal to younger, tech-savvy buyers.

The third-generation push also aligns with broader industry trends. Automakers across the globe are racing to evolve battery chemistries, integrate smarter software, and reduce EV costs — a necessity as governments tighten emissions regulations and offer subsidies to accelerate the energy transition.

Nissan’s reentry into the spotlight, however, won’t be without challenges. Supply chain disruptions, high raw material prices, and lingering skepticism from U.S. dealers are potential headwinds.

Still, the company remains confident. “We helped start the EV revolution,” said Okamoto. “Now we’re ready to lead the next phase.”

As the clock ticks toward 2025, all eyes will be on whether Nissan’s third-generation technology can not only compete — but redefine its place in the rapidly evolving EV landscape.