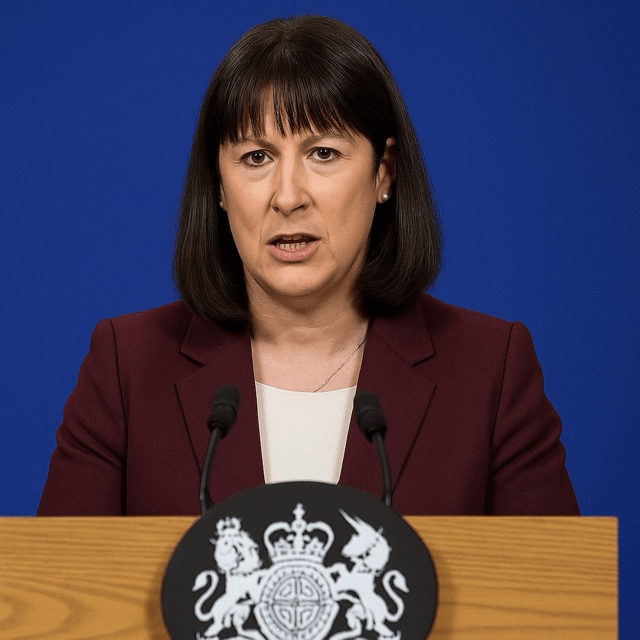

Facing opposition from building societies and consumer groups, the Chancellor signals a delay in tax-free savings changes.

The government’s highly anticipated overhaul of cash Individual Savings Accounts (ISAs) has hit a roadblock. Chancellor Rachel Reeves has decided to press pause on planned reforms next week amid fierce criticism from building societies and consumer advocacy groups. While the Treasury insists that reform is not off the table, officials acknowledge significant “differing views” on both policy details and timing.

Cash ISAs, a cornerstone of British household savings, allow individuals to deposit earnings tax-free up to an annual limit of £20,000. The government had proposed shifting subscription rules to permit flexible transfers between cash and stocks & shares ISAs in order to modernize the tax-free wrapper and encourage investment. Yet, building societies warned that the changes would undermine their deposit base, potentially leading to higher borrowing costs for mortgage holders.

Representatives from the Building Societies Association mounted a concerted lobbying effort in recent weeks. In a joint letter to the Treasury, they argued that sudden reform would destabilize retail funding and drive depositors toward riskier investment products. “We understand the need for innovation, but we urge a measured approach that safeguards access to secure, low-cost savings,” the letter stated.

Consumer Champions, including the Money Advice Trust and Which?, echoed concerns about customer confusion. They cautioned that greater freedom to shift funds could overwhelm less financially savvy savers, particularly older account holders who rely on predictable interest income. “Rebranding and complex transfer rules risk leaving thousands worse off,” warned a senior analyst at Which?

Faced with mounting pressure, Chancellor Reeves called an emergency roundtable on Tuesday, convening senior Treasury officials, industry leaders, and consumer representatives. Attendees were split on whether to proceed with the transfer flexibility proposals or to explore alternative models such as higher ISA allowances or targeted incentives for low-income savers.

Government insiders revealed that Reeves is keen to avoid a public spat with building societies, whose branch networks represent a critical conduit for new ISA subscriptions. Diplomats in the Treasury reportedly fretted that alienating key stakeholders could disrupt broader efforts to restore consumer confidence in the financial sector, particularly following the mini-budget turmoil of 2024.

The Chancellor’s decision to delay the reforms underscores the balancing act at the heart of modern fiscal policy. On one hand, the government seeks to promote long-term investment and economic growth; on the other, it must protect households from abrupt policy shifts that could erode savings resilience.

Industry commentators suggest that the Treasury may revisit reform in the autumn budget, incorporating a more phased approach or pilot schemes to test transfer mechanisms. Such a timetable would allow for deeper stakeholder engagement and targeted consumer education campaigns to ensure smooth implementation.

Labour backbenchers have been divided on the issue. Some members applaud Reeves for heeding industry warnings, while others argue that the government is missing an opportunity to democratize investment. Shadow Treasury spokesmen have called for a clear roadmap, urging the Chancellor to set out precise timelines and consultation milestones.

As the deadline for the next budget approaches, all eyes will be on No. 11 Downing Street. Will the Treasury deliver a revised blueprint that satisfies both savers and societies, or will the cash ISA remain in regulatory limbo? For now, Britain’s savers must wait, hopeful for reforms that blend innovation with stability.