Germany’s Defence Minister Pistorius calls on industry to ramp up capacity as procurement plans stretch into the 2030s

Europe stands at a pivotal moment in its defence history as governments across the continent outline ambitious spending plans in response to emerging security threats. Amid this backdrop, Germany’s Defence Minister Boris Pistorius has delivered a clear message to weapons manufacturers: ‘Stop complaining and deliver.’ Speaking to the Financial Times, Pistorius acknowledged that the government’s record-breaking defence budget had alleviated many concerns within the industry, but warned that persistent project delays and capacity constraints threaten to undermine Europe’s rearmament drive.

Since Russia’s full-scale invasion of Ukraine in early 2022, European nations have accelerated defence spending to unprecedented levels. Germany alone has unveiled plans to allocate more than €100 billion in a ‘special fund’ dedicated to military acquisitions, alongside boosting its annual defence budget to 2% of GDP by 2025. Similar commitments from France, Italy, and other NATO members reflect a collective determination to reinforce the continent’s deterrence capabilities.

Yet, despite the financial backing, the defence industry faces formidable challenges. Complex procurement processes, supply chain bottlenecks, and workforce shortages have contributed to delays in critical projects ranging from main battle tanks to next-generation fighter jets. Minister Pistorius conceded that while some programmes are back on track, “we still see that neither in terms of production capacities nor in terms of human resources have we ramped up sufficiently.”

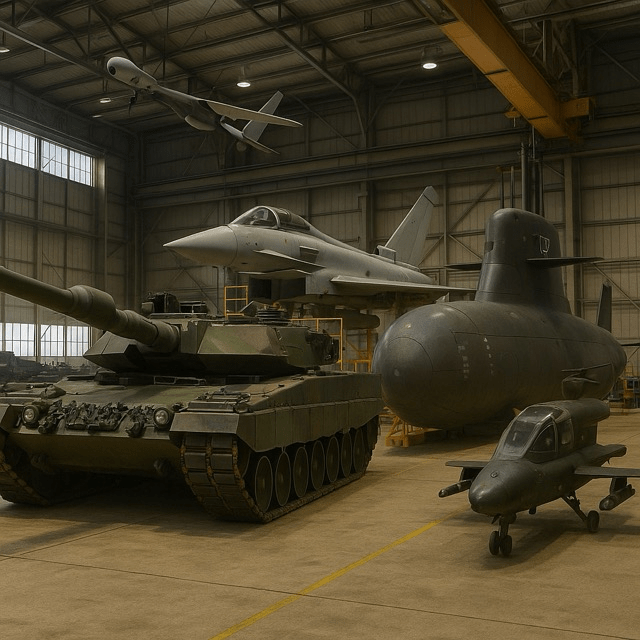

Addressing these issues, the Ministry of Defence is preparing a comprehensive procurement roadmap extending into the 2030s. The plan encompasses a wide spectrum of capabilities, including Leopards and Abrams tanks, Type 212 submarines, Eurodrone unmanned aerial systems, and the future European Fighter Aircraft—a joint initiative led by France, Germany, and Spain. The roadmap aims to synchronise project timelines, streamline approval processes, and incentivise local production to shorten delivery schedules.

Industry leaders have welcomed the clarity provided by the procurement plan but stress that implementation is key. “We now have the money and the will; the next step is to translate contracts into steel, fuel, and flight hours,” said a senior executive at a leading defence conglomerate. Companies are investing in expanded manufacturing lines, digital planning tools, and workforce training programmes to meet the surge in orders, but acknowledge that progress will take time.

Pistorius has also urged greater cooperation between defence ministries and private firms. Proposals under discussion include long-term framework agreements to provide stability for suppliers, joint venture partnerships to share technology risk, and fast-track authorisation for dual-purpose components. By reducing administrative hurdles, the ministry hopes to accelerate development cycles for critical systems such as advanced air defence and electronic warfare suites.

Nonetheless, some experts caution that Europe’s rearmament must guard against duplication and promote interoperability. With multiple countries procuring similar platforms independently, maintenance and logistics costs can balloon. A recent study by a Brussels-based think tank recommended harmonising specifications and pooling orders through joint procurement mechanisms to leverage economies of scale.

For now, Pistorius remains optimistic. “Our industry is capable of extraordinary feats when properly supported,” he told the Financial Times. “We have the contracts, the budgets, and the technologies. What we need now is commitment and speed.” With Europe’s security landscape evolving rapidly, the onus is on weapons makers to deliver on long-promised capabilities and ensure the continent’s defence ambitions become reality.

As governments fine-tune their procurement frameworks, the defence sector braces for a sustained period of high demand. From the Baltic to the Mediterranean, allied forces will be watching closely to see if Europe’s industrial base can keep pace with strategic objectives. The coming decade will reveal whether Pistorius’s call to action transforms into tangible dividends for European security.