Former President Claims Beverage Giant to Revert to Original Sweetener in U.S. Formula

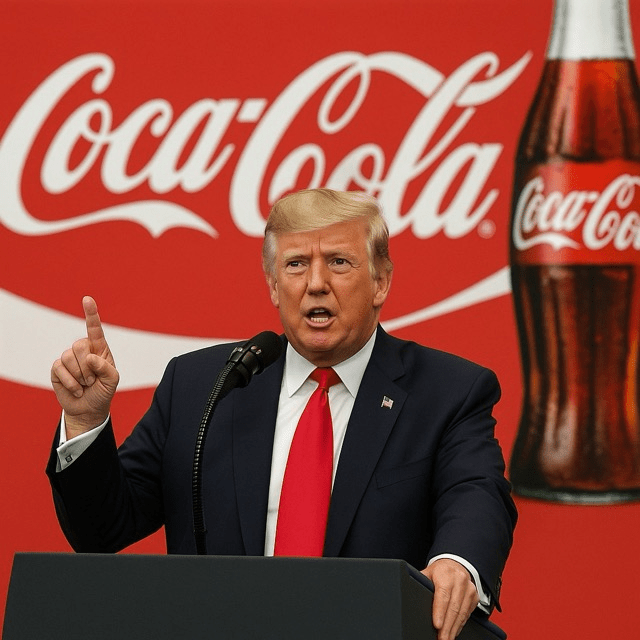

Washington D.C. – In a surprising turn for one of America’s most iconic brands, former President Donald Trump announced this week that Coca-Cola has agreed to eliminate high fructose corn syrup (HFCS) from its U.S. formula and revert to cane sugar as the primary sweetener. Trump, speaking at a rally in Tampa, Fla., described the move as “a victory for American farms and consumer health” and said that negotiations with the soft drink giant had concluded successfully.

“For decades, Coca-Cola has used high fructose corn syrup, which is deeply unpopular with many Americans,” Trump told supporters. “Now, thanks to our discussions, they are switching back to real cane sugar, just like the old days. It’s great for taste, it’s great for farmers, and it’s great for consumers.” The announcement prompted cheers and waves of “USA!” chants among the crowd.

Coca-Cola, which sources HFCS domestically as a cost-effective alternative to imported sugar, confirmed that the company has begun exploring adjustments to its syrup formula. In a brief statement, the Atlanta-based beverage maker said: “We are evaluating a pilot program to test cane sugar in select markets. Our goal is to maintain the taste our consumers expect while responsibly managing supply chain considerations.”

Industry analysts note that the switch could have significant implications for both agricultural and beverage sectors. HFCS, derived mainly from corn, has been the predominant sweetener in U.S. soft drinks since the 1980s, when domestic corn subsidies made it cheaper than refined sugar. Cane sugar, largely imported from countries like Mexico and Brazil, typically carries higher production and transport costs.

“If Coca-Cola fully transitions to cane sugar, retail prices may rise to offset increased input costs,” said Dr. Emily Harris, an economist at the University of Georgia’s Food Industry Research Center. “However, there is a segment of consumers willing to pay a premium for what they perceive as a more ‘natural’ product.”

The potential switch also carries political overtones. Corn growers and biofuel producers have long lobbied for HFCS use to support domestic agriculture, while sugarcane farmers have sought protection from cheaper imports through tariffs and quotas. Trump’s announcement, which he framed as support for U.S. sugarcane growers, drew immediate responses from both sides.

In a statement, the American Sugar Alliance praised the development, calling it “a welcome sign that major corporations are listening to consumers and supporting American farmers.” Conversely, the National Corn Growers Association cautioned against hasty changes. “HFCS remains a critical market for American corn producers,” the group said. “We urge Coca-Cola to carefully consider the economic impact on rural communities.”

Consumer advocacy organizations welcomed the move for potential health benefits. Studies have linked excessive HFCS consumption to metabolic issues, though scientific consensus holds that HFCS and cane sugar are similar in fructose and glucose composition. “Reducing the presence of industrially processed sweeteners is a positive step,” said Maria Gonzalez of the Center for Nutrition Education. “Even if the sugar molecules are technically the same, public perception and cultural significance matter.”

Earlier this year, Coca-Cola launched a limited-edition “Craft Cola” line sweetened with cane sugar in select markets, garnering positive reviews for its flavor profile. The company’s Bliss Refresh product, made with cane sugar and natural flavors, sold out within weeks. That success likely informed Coca-Cola’s broader considerations about sweetener strategy, executives suggest.

Supply chain logistics pose another challenge. Cane sugar requires different handling and storage compared to HFCS, which is shipped and pumped in liquid form. Transitioning plants and distribution systems would involve capital investment and operational adjustments. Coca-Cola’s statement emphasized that any widespread change would occur “when we are confident we can deliver consistent quality at scale.”

Market testing is expected to begin in Florida and Texas later this year, with consumer feedback closely monitored. If positive, Coca-Cola might extend the cane sugar formula nationally by mid-2026. The possibility has reignited nostalgia for “Mexican Coke,” a popular import sold in U.S. specialty stores that uses cane sugar and has long been celebrated for its taste.

For Trump, the announcement serves as a high-profile win in his ongoing engagement with corporate America. Since leaving office, he has made a point of leveraging his business connections to influence brand decisions. “This is how you make deals,” Trump said. “You call the shots, you show you care about everyday Americans, and you get results.”

As Coca-Cola and its rivals—PepsiCo, Dr Pepper Snapple Group—watch closely, the beverage industry may face a broader debate over sweetener standards, health perceptions, and agricultural policy. For consumers, the prospect of sipping mainstream Coke crafted with cane sugar could blur the line between nostalgia and commercial reality.

Whether the high fructose era has reached its twilight in America’s favorite fizzy drink remains to be seen. But amid the political rhetoric and sugar wars, one thing is clear: the formula for one of the world’s most beloved beverages may be on the cusp of a significant—and potentially sweet—transformation.