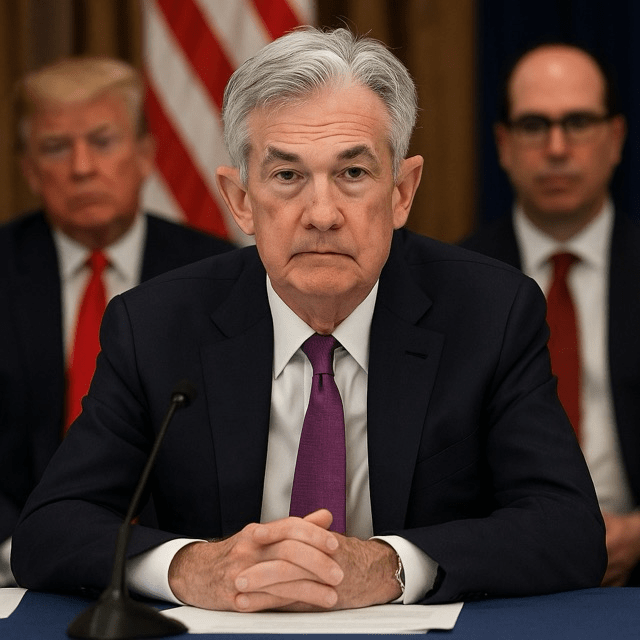

JPMorgan CEO and Treasury Secretary Warn of Risks as Trump Administration Eyes Powell’s Replacement

In Washington D.C. this week, JPMorgan Chase CEO Jamie Dimon and Treasury Secretary Scott Bessent delivered a rare unified warning about the importance of Federal Reserve independence, speaking out amid escalating signals that the Trump administration may seek to replace Chair Jerome Powell. Dimon declared that “the independence of the Fed is absolutely critical,” emphasizing that political interference would undermine monetary stability. Bessent simultaneously confirmed that “a formal process” to identify Powell’s successor has begun, marking an unprecedented level of executive branch involvement in Fed leadership decisions.

Dimon’s remarks came during JPMorgan’s second-quarter earnings call, where he cautioned that any attempt to influence interest rate policy for short-term political gain could trigger market volatility and erode confidence in U.S. economic leadership. He noted that Fed autonomy has historically enabled the central bank to navigate crises—from the 2008 financial meltdown to pandemic-era stimulus—without partisan tug-of-wars dictating policy choices (Business Insider; Banking Dive).

Treasury Secretary Scott Bessent elaborated on the administration’s plans during a briefing at the Treasury Department, stating that the White House has initiated a “formal process” to review candidates for Fed chair. Reports suggest former Fed governor Kevin Warsh and National Economic Council Director Kevin Hassett are among the frontrunners. Bessent urged that while Powell’s current term runs through 2026, consideration of fresh leadership aligns with standard succession norms—albeit in the glare of political scrutiny.

The U.S. Federal Reserve’s statutory independence dates back to the Banking Act of 1935, designed to shield monetary policy from electoral cycles. Legal scholars note that under current law, the president may only remove a Fed chair “for cause,” such as malfeasance. Historical precedents—Nixon’s 1972 pressure on then-Chair Arthur Burns and Clinton-era factions—underscore the risks when administrations seek to sway rate decisions to fit political agendas (Reuters; Wikipedia).

Financial markets have already reacted to the mounting uncertainty. Treasury yields spiked and the dollar weakened on initial reports of executive pressure, before stabilizing once officials emphasized procedural norms. Senate Banking Committee members, including Chairman Pat Toomey, have publicly urged respect for the Fed’s autonomy, warning that eroding institutional safeguards could drive inflation higher and borrowing costs for consumers skyward (Reuters; MarketWatch).

Economists caution that politicizing central bank leadership could damage the Fed’s credibility in its dual mandate—controlling inflation and maximizing employment. Dr. Lisa Cook of Michigan State University warned that “if markets fear policy motives are driven by electoral politics, long-term interest rates will rise, undermining growth,” while defenders of the administration argue that fresh leadership could accelerate rate cuts to support lagging sectors (Business Insider; Reuters).