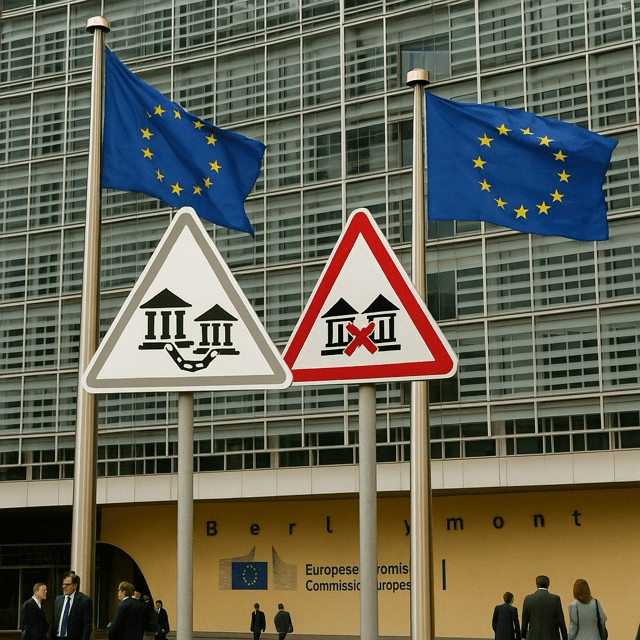

Brussels issues twin warnings as it ramps up pressure on member states to allow financial consolidation, aiming to revive competitiveness and stabilize the eurozone economy.

BRUSSELS — The European Commission has stepped up its campaign to encourage banking sector consolidation, issuing coordinated warnings this week to Italy and Spain over what it describes as politically motivated interference in cross-border mergers. The move signals Brussels’ growing frustration with national barriers that hinder the creation of stronger, pan-European banks.

Several EU officials told the Financial Times that the two cases were ‘absolutely connected,’ part of a broader push to unblock a sector long seen as fragmented and underperforming compared to its U.S. and Asian counterparts. The Commission’s goal: to build a more resilient banking system capable of financing the bloc’s green transition and post-pandemic recovery.

In its message to Rome, the Commission criticized the Italian government’s informal efforts to prevent foreign takeovers of domestic lenders. Rome has used so-called ‘golden power’ mechanisms to scrutinize potential deals — a tactic Brussels says must not be abused to protect narrow national interests.

Meanwhile, Spanish regulators came under fire for delaying approval of a high-profile merger between two regional institutions, raising doubts about the country’s commitment to the EU’s financial integration agenda. ‘These actions undermine the integrity of the single market,’ said one senior EU source.

Banking consolidation has long been a contentious issue in Europe, where governments often see lenders as strategic national assets. But Commission officials argue that greater scale is essential to reduce systemic risk and improve profitability in an era of rising interest rates and competition from fintech firms.

‘It is time to move beyond defensive nationalism,’ said an EU competition adviser. ‘Europe needs competitive banks that can operate at scale — not a patchwork of regional players clinging to outdated protections.’

The warnings are also part of a wider effort by the Commission to kickstart economic growth in the eurozone, which continues to lag behind global peers. Analysts say structural reforms, including in finance, are vital to ensuring sustainable long-term investment and productivity.

Whether Rome and Madrid will heed the Commission’s call remains uncertain. But with Brussels signaling it is prepared to escalate the issue, a broader confrontation over financial sovereignty and EU integration may be looming.