Multinationals plug engineer gap by establishing global capability centres for AI and big-data tasks

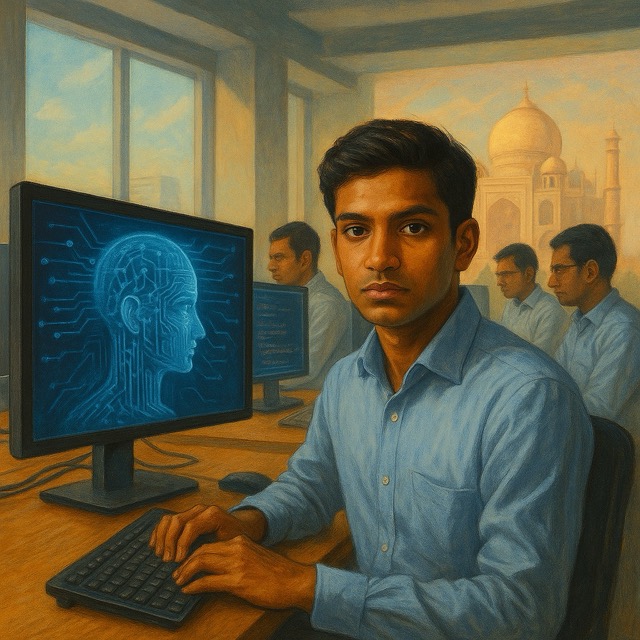

As competition for artificial intelligence talent heats up, multinational corporations are increasingly looking beyond their domestic talent pools to meet core AI demands. In recent months, global names such as McDonald’s and Bupa have unveiled plans to establish so-called Global Capability Centres (GCCs) in India—sophisticated back-office hubs designed to manage a broad spectrum of big-data and AI-driven tasks.

The talent crunch in developed markets has become acute. In the United States, Europe and parts of Asia, major tech hubs are reporting record vacancies for AI engineers, data scientists and machine-learning specialists. The pace of AI innovation continues to accelerate, but the pipeline of qualified candidates has not kept pace. As a result, companies are faced with unfilled positions critical to delivering new AI-powered products and services.

In response, many firms are doubling down on India’s deep reservoir of STEM graduates. Over the past decade, India’s higher education system has ramped up production of engineers and computer scientists, and the country now graduates over half a million engineering students annually. This talent pool is increasingly upskilled in machine learning, natural language processing and advanced analytics, often at a fraction of the cost of hiring in Western capitals.

McDonald’s, the fast-food giant known for its golden arches, announced in May the creation of a Global Capability Centre in Bengaluru. The new hub will consolidate the company’s AI-driven menu optimization, customer analytics and predictive maintenance for kitchen equipment. McDonald’s global CIO noted that domestic hiring challenges had delayed key AI initiatives, pushing the firm to seek a location with both talent depth and scalable infrastructure.

Similarly, UK healthcare group Bupa has committed to growing its Pune-based centre into a full-fledged AI innovation arm. Bupa’s GCC currently supports data management and health-insurance analytics but will expand to include natural language understanding for patient support chatbots, fraud detection algorithms and telehealth platform enhancements. The company’s chief digital officer highlighted that tapping into India’s expertise was essential to accelerate Bupa’s digital transformation timeline.

While India remains the primary destination, other emerging markets are vying for a share of the back-office boom. The Philippines, Vietnam and parts of Eastern Europe are investing heavily in their digital infrastructure and upskilling programmes. Nevertheless, India’s early-mover advantage—coupled with established IT parks and government incentives—gives it a lead that many believe will be hard to dislodge.

This trend is not limited to service-sector giants. Financial institutions such as HSBC and Standard Chartered have long-standing data centres in Mumbai and Gurgaon, focusing on risk analytics and algorithmic trading models. Consumer brands like Unilever and PepsiCo leverage Chennai and Hyderabad centres for supply chain optimization and real-time sales forecasting.

Critics of the shift warn of potential drawbacks. Offshore centres can introduce cultural and time-zone frictions, leading to coordination challenges with home-based teams. Data sovereignty and regulatory compliance also require careful navigation, especially when handling sensitive customer information. Companies must invest in robust governance frameworks to ensure that data protection laws in India and the EU, for example, are both respected.

Proponents counter that well-managed GCCs can foster innovation by bringing together diverse perspectives. Many centres now operate as ‘innovation labs,’ where joint teams co-develop machine-learning models with counterparts in London, New York or San Francisco. Video collaboration tools and structured agile processes help bridge distance, enabling seamless knowledge transfer and iterative development.

Looking ahead, experts forecast that AI back-office hubs will evolve beyond task execution to strategic partnership roles. They predict the emergence of ‘AI centres of excellence’ in India, responsible not only for coding and analytics but also for guiding global AI policy, ethical frameworks and governance standards within multinational groups.

Ultimately, the move underscores a new phase in the globalization of AI. By exporting core AI development to cost-effective, talent-rich back offices, companies hope to maintain momentum in the AI race. Whether these Global Capability Centres will deliver long-term competitive advantage—or simply serve as stopgap solutions to talent shortages—remains to be seen.