Singapore’s sovereign wealth fund takes 25% position in Spanish broadband partnership to accelerate fiber rollout

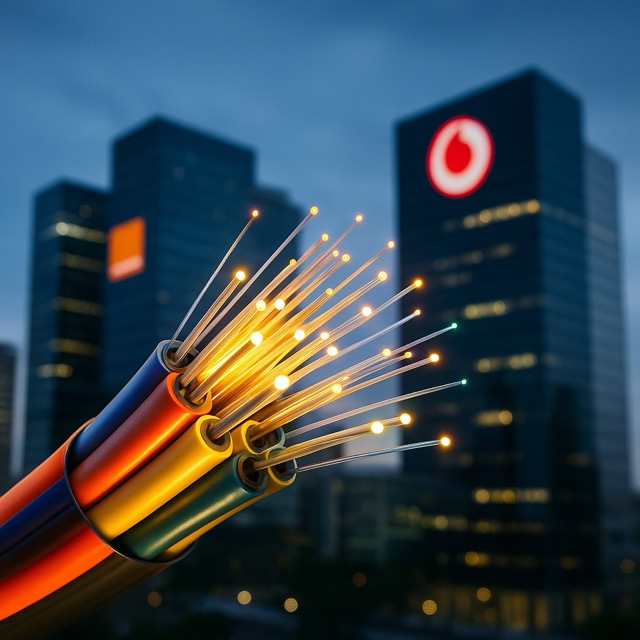

Madrid – In a significant boost to Spain’s broadband infrastructure, Singapore’s sovereign wealth fund GIC is set to acquire a 25 percent stake worth approximately €1.4 billion in a joint fiber-optic venture between MasOrange and Vodafone Spain. The deal, announced jointly today in Madrid and Singapore, marks one of the largest private investments in Spain’s telecom sector this year.

The newly formed company, Fibre España, combines MasOrange’s regional fiber networks—spanning Andalusia, Valencia, and Catalonia—with Vodafone Spain’s national wholesale platform. With GIC’s capital infusion, Fibre España aims to accelerate the rollout of high-speed broadband services to over two million underserved households by 2028.

“We are pleased to partner with MasOrange and Vodafone Spain to drive the expansion of state-of-the-art fiber infrastructure,” said Lim Hock Ling, Senior Managing Director at GIC. “This investment aligns with our long-term strategy to back critical digital infrastructure in key markets and supports Spain’s goals of nationwide connectivity.”

MasOrange CEO Javier Montoya highlighted the importance of the partnership: “Joining forces with Vodafone’s established wholesale network and GIC’s global expertise enables us to fast-track deployment timelines, particularly in rural and suburban areas that have historically lagged in fiber coverage.” Vodafone Spain’s Head of Wholesale, Elena García, added that “the collaboration will improve network resilience and capacity, catering to growing consumer and enterprise demand for ultra-fast, reliable connectivity.”

The total investment funding, including contributions from MasOrange and Vodafone Spain, will exceed €5.6 billion over the next four years. GIC’s €1.4 billion tranche will be deployed in multiple tranches, contingent on achieving rollout milestones and regulatory approvals from Spain’s National Commission on Markets and Competition (CNMC).

Industry analysts view GIC’s entry as a vote of confidence in the Spanish telecom market, which has undergone a wave of consolidation and modernization in recent years. “International investors are recognizing the stable cash flows and strategic importance of fiber infrastructure,” noted Miguel Torres, an analyst at Iberian Capital Advisors. “This transaction could pave the way for similar partnerships in other European markets.”

Spain’s government has prioritized broadband expansion as part of its digital agenda, allocating significant EU Recovery and Resilience Facility funds to support public-private initiatives. With GIC’s involvement, the Fibre España venture is expected to qualify for additional grants and low-interest loans aimed at bridging the digital divide.

Market observers will watch closely how GIC’s governance role—entailing two board seats and veto rights over major decisions—affects the venture’s strategic direction. MasOrange and Vodafone Spain have assured stakeholders that operational autonomy and customer-centric service commitments will remain intact.

As Fibre España ramps up construction of last-mile connections and wholesale infrastructure, millions of Spanish homes and businesses stand to benefit from faster internet speeds, lower latency, and improved network reliability. With this landmark investment, Spain edges closer to achieving its ambition of universal ultra-broadband coverage by 2030.