Munich Re warns of volatility as alternative capital reshapes catastrophe cover

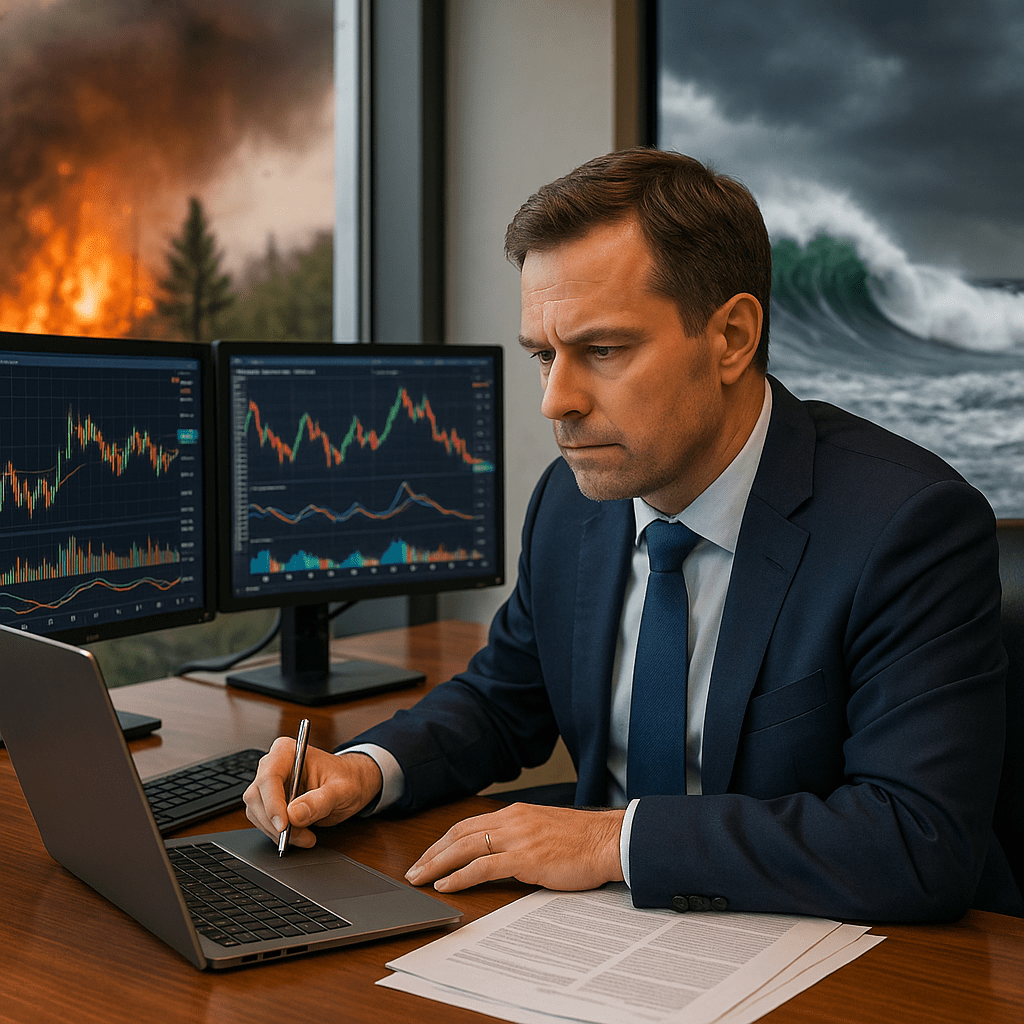

London— The centuries-old reinsurance industry, long a bastion of stability in the face of natural disasters, is facing mounting pressure from a new wave of entrants: hedge funds and private investors. According to a senior director at Munich Re, the world’s largest reinsurer, the influx of “alternative capital” into catastrophe coverage markets is amplifying risk and could threaten the sector’s delicate equilibrium.

Speaking at a conference in Frankfurt this week, the executive cautioned that the traditional reinsurance model — in which large, established firms pool global risks and spread losses over time — is being upended by investors seeking fast, outsized returns. “We are entering a phase where volatility itself is becoming a structural feature of the reinsurance market,” he said.

The Lure of Catastrophe Bonds

For over a decade, investors have been drawn to catastrophe bonds and insurance-linked securities (ILS), financial instruments that pay high yields unless a defined disaster strikes. These products offered diversification for hedge funds and pension funds, as returns were largely uncorrelated with equities or bonds.

But what began as a niche supplement to traditional reinsurance has ballooned. In 2024 alone, global issuance of catastrophe bonds exceeded $20 billion, a record high. Hedge funds, armed with sophisticated risk models, have been aggressively expanding their positions, competing directly with reinsurers in bidding for contracts with primary insurers.

“Alternative capital was once considered a stabilising complement to our business,” said the Munich Re director. “Today, it is challenging the very foundations of how risk is priced and absorbed.”

Rising Climate Risks, Rising Stakes

The timing could hardly be more delicate. Climate change is intensifying the severity and frequency of hurricanes, floods, and wildfires. Analysts warn that the probability of ‘mega-catastrophes’ — single events causing losses of $100 billion or more — has climbed sharply in recent years.

Traditional reinsurers have weathered such storms through deep reserves, decades of underwriting experience, and global diversification. Hedge funds, by contrast, are less constrained by regulatory capital requirements and can enter and exit the market at will. Critics argue this short-term approach could destabilise pricing just when insurers need reliability most.

“The real risk is that when a major disaster hits, some investors will simply walk away,” said a London-based insurance analyst. “Reinsurers can’t. They have to pay claims, rebuild trust, and prepare for the next event.”

Market at a Crossroads

The shifting balance of power has already begun to reshape pricing. Some insurers report that hedge fund-backed capacity has pushed premiums down for catastrophe cover, a short-term boon for buyers but a long-term worry for market sustainability.

At the same time, regulators in Europe and the United States are grappling with how to monitor the growing role of non-traditional players in what has historically been a tightly controlled industry. Calls are mounting for enhanced disclosure requirements for catastrophe bonds and stricter oversight of investor-backed reinsurance vehicles.

“The integration of alternative capital is not inherently bad,” the Munich Re executive stressed. “But if left unchecked, it risks turning reinsurance into just another speculative asset class. That would be dangerous not just for insurers but for the communities that depend on timely payouts when disaster strikes.”

A Future of Uncertainty

As wildfires scorch California and hurricane season looms in the Atlantic, the debate over reinsurance’s future has rarely felt more urgent. Industry veterans argue that resilience — financial and social — depends on a system that prioritises long-term stability over short-term gain.

For now, the reinsurance market remains robust, with both traditional firms and hedge funds flush with capital. But beneath the surface, tensions are rising. Whether the influx of speculative money strengthens or undermines the market will depend on how regulators, reinsurers, and investors themselves navigate the volatile years ahead.

“Ultimately, reinsurance exists to ensure that society can recover from disaster,” the Munich Re director concluded. “If we forget that, we risk learning the hard way.”