Named in Giorgio Armani’s will as a preferred buyer, LVMH is seen as the front‑runner for a first 15% stake—while it deepens Italian ties from Moncler’s boardroom to the Tod’s deal.

The shock of Giorgio Armani’s death on September 4 has given way to a more pragmatic phase in Milan: deciding who will carry one of Italy’s most influential fashion houses into its next half‑century. In a surprise coda to a career built on independence, the designer’s will instructs his heirs to sell an initial 15% of the Armani group within 18 months, with a second tranche of 30% to 54.9% to follow within five years—or, failing that, to prepare a stock‑market listing. Among the “preferred” counterparts named in the document are French luxury titan LVMH, beauty leader L’Oréal and eyewear powerhouse EssilorLuxottica. The Fondazione Giorgio Armani, created in 2016 to safeguard the house’s ethos, must retain at least 30% and will act as a permanent guardian of brand principles.

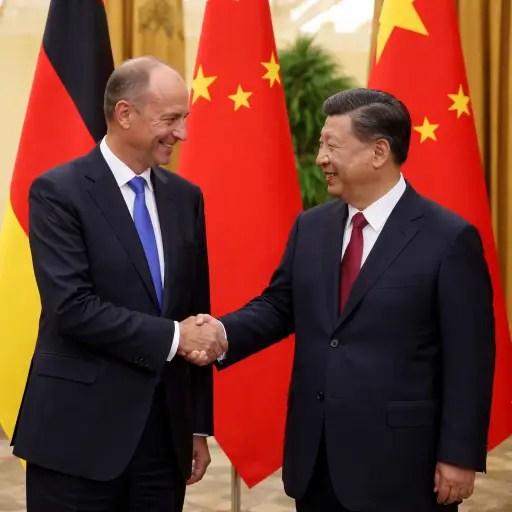

That shortlist instantly placed Bernard Arnault’s LVMH in pole position—at least in perception. The world’s largest luxury group has both the operational firepower and the balance sheet to absorb a marquee label without flinching. Crucially, it has also been methodically consolidating influence across Italy. In late 2024 LVMH financed an investment into Double R, the holding vehicle of Moncler chairman and chief executive Remo Ruffini; in March this year, Alexandre Arnault was proposed for Moncler’s board. A standstill agreed with Ruffini’s camp caps the combined holding below 20% for several years, but the tie‑up gives LVMH proximity to one of Italy’s most successful luxury stories and a voice in its governance.

For Armani, the calculus is more delicate. The brand is both a business—€2.3 billion in revenue last year as the luxury market cooled—and a national symbol. The will keeps the foundation as the house’s moral backstop and allocates significant voting power to Pantaleo “Leo” Dell’Orco, the designer’s long‑time confidant and head of menswear. The architecture is meant to reconcile continuity with scale: any buyer would have to accept a guardian with vetoes on strategic moves, even as it plugged Armani into a global machine.

LVMH has already signalled respect for that arrangement. Arnault publicly called it an honour to be named a potential partner and said that, if the groups were to work together, LVMH would focus on strengthening Armani’s global presence. In practical terms, that would mean tapping a retail platform that spans the world’s best flagships, a clienteling engine built on first‑party data, industrial know‑how in leather goods and couture, and a logistics network that can turn creativity into cash flow at scale. The blueprint isn’t hypothetical: Bulgari—acquired in 2011—kept its Roman identity while expanding manufacturing in Valenza, now home to what LVMH touts as the world’s largest jewelry factory.

Yet LVMH is not the only logical fit. L’Oréal has long managed Armani’s fragrance and beauty, a high‑margin engine that underwrites brand storytelling; EssilorLuxottica manufactures the label’s eyewear, one of its most visible lines. Each has strategic reasons to deepen ties. An all‑French outcome would inflame anxieties in Italy about “sovereignty” in fashion, a debate that flares every time a homegrown champion becomes an acquisition target. A compromise could take shape in a staged deal: place a minority stake first with a partner that secures licensing continuity, then reassess an industrial tie‑up when the cycle turns.

The numbers argue for patience. Armani’s EBITDA fell 24% in 2024 amid a deliberate investment push—renovating flagships and bolstering e‑commerce and client service—while revenues slipped 5% to €2.3 billion as demand softened in China and the U.S. Analysts peg the group’s enterprise value anywhere between €5 billion and €12 billion depending on growth assumptions; some estimates suggest that at roughly six times sales, a price near €14 billion would not stretch LVMH’s cash generation. But valuations alone won’t decide the outcome. Armani’s heirs must balance price against a promise of continuity, and any buyer will have to demonstrate humility in the face of a brand whose cultural footprint far exceeds its P&L.

LVMH’s pattern in Italy underscores why it is seen as the favourite. Beyond Bulgari, it has kept a decade‑long minority in Tod’s and backed the 2024 deal—via L Catterton, the private‑equity firm it sponsors—that is taking the shoemaker private. Its financing of Double R has given it optionality at Moncler without the obligations (or political sensitivities) of a full takeover. The French group has also poured capital into Italian manufacturing, from leather goods to jewelry, positioning itself as both a customer and an employer in the country’s luxury supply chain.

Moncler is the most immediate example of this strategy at work. Remo Ruffini’s transformation of a niche skiwear outfit into a global “performance luxury” heavyweight has drawn covetous glances across Paris. LVMH’s minority tie‑up—paired with a board role for the Arnault family—points to optionality: close collaboration on retail and supply chain today, and, if conditions allow in the future, a pathway to deeper alignment. A standstill limits how far the parties can go in the near term, but even a passive position buys insight, influence and time.

If LVMH does clinch the first Armani tranche, the industrial logic is clear. Armani would slot into a portfolio where Dior and Fendi anchor leather goods and couture, while Celine, Loewe and Givenchy speak to younger fashion customers. Armani’s brand equity—serene tailoring, red‑carpet legitimacy, a hospitality arm that punches above its financial weight—fills a space between power‑logo and purist minimalism, one that has been resurgent in the era of “stealth wealth.” Cross‑category synergies would extend from fragrances and eyewear to watches, home and travel retail.

There are, of course, other scenarios. The foundation could place the initial 15% with L’Oréal or EssilorLuxottica, locking in continuity in high‑margin licences while postponing a decision on a full industrial partner. It could also float a minority stake on the Milan exchange, using public markets to set a reference price and broaden employee ownership, then revisit strategic options once the macro cycle improves. A listing would cheer advocates of Italian capital markets but wouldn’t solve the succession question on its own.

What is clear is the timeline. The will is explicit: no sale before one year, completion of the first tranche within 18 months, and a second block within five years. That schedule gives Milan Fashion Week at least two seasons to celebrate the brand’s 50th anniversary on its own terms (and to stage the designer’s final planned runway), while giving bankers time to model scenarios and regulators to weigh any systemic risks to Italy’s luxury supply chain. In the background, consolidation pressures are intensifying as China’s recovery proves uneven, U.S. aspirational demand remains choppy and borrowing costs stay elevated.

For Italy, the stakes run deeper than a single deal. Armani’s minimalist language helped define modern Italian style; its ateliers, suppliers and stores are woven into the economic life of Lombardy and beyond. A sale to LVMH would not erase that history, but it would confirm a truth that has shaped the sector for two decades: Paris sets the pace, and the best way to keep Italian craftsmanship flourishing may be to plug it into the broadest possible platform—with conditions. The foundation’s vetoes and permanent stake are designed to be those conditions.

The next few months will be about choreography as much as negotiation: quiet bank mandates; discreet boardroom visits between Milan and Paris; calibrated public statements that project stability. Expect watchful rivals, too. Even if they are not named in the will, European groups with appetite and cash will assess whether a minority toehold could evolve into something larger. In the end, the “LVMH track” is not inevitable. It is simply the clearest route mapped by the man who spent a lifetime insisting that style is the opposite of noise—and who, in death, wrote a script designed to preserve that silence while letting the brand speak more loudly to the world.