Early readings point to persistent weakness in Europe’s factory sector and only modest relief in services, leaving growth prospects for the euro‑area fragile.

The latest flash survey of purchasing managers across the euro‑zone suggests a subdued beginning to the fourth quarter. Economists had widely expected the manufacturing Purchasing Managers’ Index (PMI) to hover around 49.5, signalling contraction, while the services PMI was forecast to dip to 51.1, pointing to slow but positive growth.

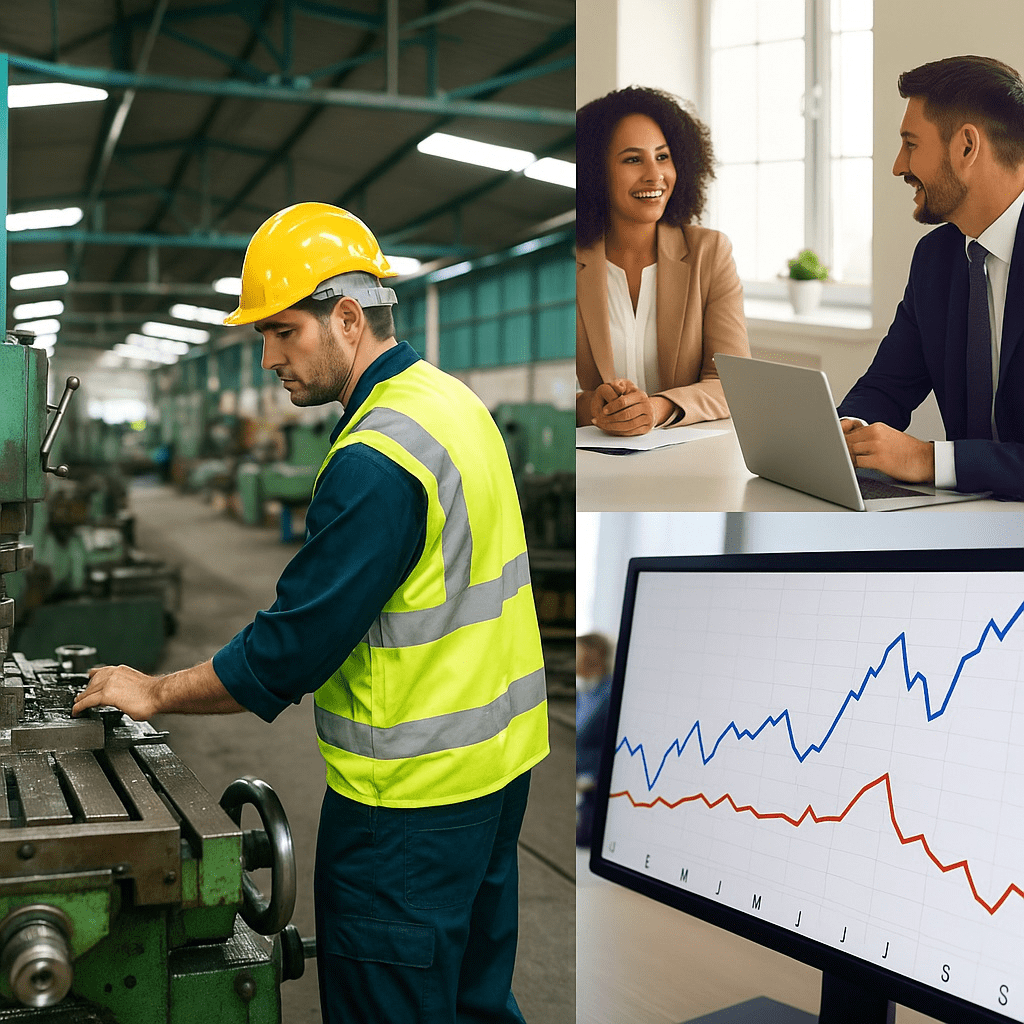

In the manufacturing segment, the outlook remains uncomfortably flat. The consensus estimate of a 49.5 reading would mark a continuation of contraction, with the sector still unable to push past the 50.0 threshold that demarcates expansion from decline. Although recent figures had shown some stabilisation, the sector remains under pressure from weak export demand, material costs and capital investment hesitancy.

Meanwhile, expectations for the services sector — the largest component of the euro‑zone economy — point to a modest slowdown. The forecast of 51.1 indicates growth is still present but soft; services firms are likely struggling with subdued consumer spending and uncertainty about the wider macro environment.

Analysts caution that even if the composite PMI lifts somewhat, underlying momentum remains weak. According to a recent note from Capital Economics, the composite flash PMI is expected to climb to 52.2 — a 17‑month high — but the firm still anticipates growth of just around 0.2% quarter‑on‑quarter for the euro‑zone economy.

Key sectoral dynamics

- Manufacturing: Firms continue to report falling new orders and weak export demand, which keep factory activity weighed down. The expectation of a 49.5 reading underscores the lack of a meaningful rebound. Employment and investment in the sector remain under pressure.

- Services: Although the services PMI is expected to stay above 50, the trajectory suggests moderation. Firms are facing cautious consumer sentiment, heightened cost pressures and geopolitical/spill‑over risks (including energy costs and supply chain disruptions).

- Regional divergences: The data also reveal diverging patterns across countries. For example, France remains a weak spot with continuing contraction in business activity, whereas Germany is showing a relatively stronger read‑through.

Implications for the economy and policy

For policymakers at the European Central Bank (ECB) and for market watchers, the flash PMI numbers coming into the end of October will be closely monitored for signs of a sustained recovery or persistent stagnation. A manufacturing PMI still below 50 keeps the risk of a broader industrial slump alive, while a soft services reading offers only limited reassurance.

Should growth remain tethered to low levels, the ECB may face renewed calls to maintain an accommodative stance or deploy further stimulus. At the same time, inflation in the euro‑zone remains moderate (with the Harmonised Index of Consumer Prices at 2.2 % in September) but services inflation remains elevated, creating a policy dilemma.

Outlook to watch

- The upcoming release of the full October flash numbers will either confirm or challenge current expectations — if manufacturing drops sharply or services falter further, growth risks will rise.

- Companies in the manufacturing sector are already signalling cautious hiring and investment, and any deterioration in global demand (e.g., from China or the US) could deepen the slowdown.

- On the bright side, the services sector may provide a stabilising offset — but only if domestic demand holds up and cost pressures remain manageable.

- Markets and currency traders will pay attention to how the PMI influences EUR/USD and bond yields — weaker data could prompt a shift in expectations around ECB policy and carry implications for the euro.

In short: while the euro‑zone economy may avoid outright contraction today, the flash PMI data pointing to manufacturing below 50 and softer services growth imply that the recovery remains fragile. The early signals are that Europe’s growth engine is sputtering, and the remainder of the quarter may bring more of the same unless a stronger rebound in demand takes hold.