As U.S. export controls tighten, Nvidia’s leader signals hope for China access — yet acknowledges it depends on Washington’s next move.

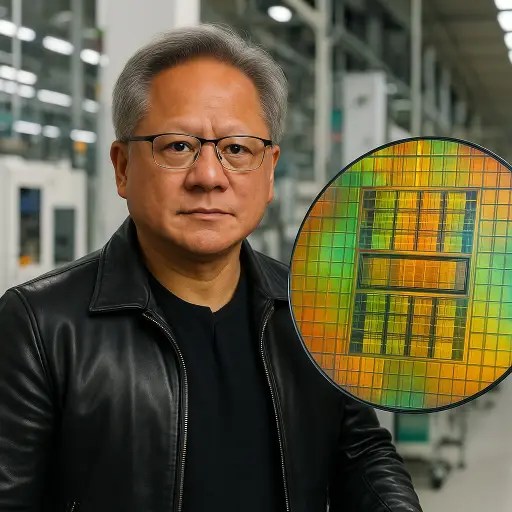

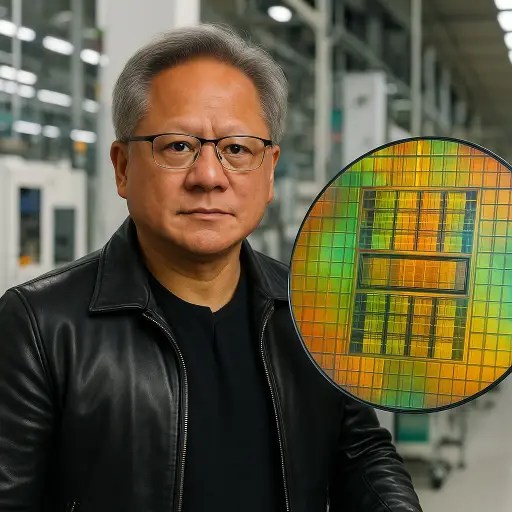

In a media‑briefing during a visit to South Korea, Nvidia Chief Executive Officer Jensen Huang expressed cautious optimism that the company’s upcoming “Blackwell”‑architecture artificial‑intelligence chips could eventually be sold in China — but made clear that the ultimate decision rests with Donald Trump and the U.S. government.

During the press encounter, Huang said he “doesn’t know” when or under what conditions the advanced chips would be eligible for export to the Chinese market, but added: “I hope so someday.” The comments underscore the complex interplay of business ambition, geopolitics and technology policy that Nvidia now faces, as the company seeks to maintain its global leadership in AI hardware amid intensifying U.S.–China rivalry.

Business ambition meets geopolitics

For Nvidia, China remains a market of exceptional importance. Historically, Chinese customers have accounted for a sizable portion of its revenue, particularly in AI and datacentre deployments. But over recent years, U.S. export controls have curtailed access to the most advanced chips, as Washington seeks to prevent high‑end computing power — and the AI models that depend on it — from aiding potential adversaries.

Huang noted that the firm had been “hoping for non‑zero market share” in China, but said current expectations are shifting toward having effectively “zero” unless regulatory conditions change. That admission signals a sobering recognition of the headwinds facing Nvidia’s China ambitions.

Yet, Huang stressed that from Nvidia’s perspective, allowing the company’s advanced chips to flow into China would be “in the best interest of the United States. It’s in the best interest of China.” He argued that restricting access could backfire by encouraging China to rely wholly on domestic alternatives and reducing U.S. leverage.

The Blackwell chips and export control terrain

The chips at the centre of this discussion are built on Nvidia’s upcoming Blackwell architecture — its next‑generation AI accelerator platform. While specific details remain closely held, industry reports indicate Nvidia is also developing a China‑specific variant of Blackwell that would trade off some performance in order to satisfy export‑licensing rules.

The U.S. government’s export control regime has, in recent years, targeted advanced AI‑capable chips going to China, particularly those with high memory bandwidth, specialised architectures or potential dual‑use applications. As a result, even as Nvidia pushes to maintain technological leadership, it must respect licensing barriers and national‑security constraints.

According to publicly available financial‑markets commentary, Nvidia’s stock nudged higher on the day of Huang’s remarks, reflecting investor optimism that a breakthrough in China access could open a new growth trajectory.

Why President Trump holds the switch

Perhaps most telling in Huang’s remarks was how clearly he placed the decision in the hands of President Trump. In recent discussions with China’s leadership, Trump publicly noted that semiconductors were on the agenda, but specified that Nvidia’s Blackwell chips were not.

Huang said he remains “delighted” by the high‑level summit between the U.S. and China and hopes it yields progress — but admitted: “I’m not aware of what was actually discussed” concerning Blackwell in those talks. The implication: even as Nvidia executes its technology roadmap, its access to the Chinese market now hinges not just on business execution but on diplomatic and national‑security calculus.

For Nvidia and its shareholders, that means the path to China sales is less about supply chains and more about geopolitical strategy. The company must wait for a policy shift — or a license approval — before the Blackwell chips can legitimately enter the Chinese market.

Implications and what to watch

For Nvidia: A successful China launch would amplify the company’s global footprint, capture some of the world’s largest AI‑infrastructure demand, and strengthen its economies of scale. But failure to achieve that access may leave its growth more constrained to non‑Chinese markets.

For U.S.–China relations: This case becomes a proxy for broader competition in AI, semiconductors, and high‑tech sovereignty. If U.S. policy relaxes, it could signal a strategic realignment; if not, China may accelerate domestic chip capability and reduce dependence on U.S. exporters.

For industry watchers: Key signals to monitor include whether the U.S. issues a formal license for Blackwell exports to China, whether Nvidia introduces a performance‑degraded variant for the Chinese market, and how Chinese state‑backed firms respond (either by embracing Nvidia or accelerating indigenous alternatives).

For investors: The outcome could meaningfully shift Nvidia’s addressable market size. But the risks remain substantial — regulatory delay, trade backlash, or direct competition from Chinese chipmakers like Huawei Technologies could all erode potential gains. Huang himself warned of the company’s competitors: “It is foolish to underestimate the might of China and the incredible competitive spirit of Huawei.”

Final word

On this early November morning, Nvidia stands at a crossroads. Its CEO hopes that the firm’s Blackwell chips will someday be sold in China — a major prize in both commercial and strategic terms. But he also realises the gatekeeper is not just micro‑architecture or market demand: it is Washington’s policy and President Trump’s decision. Until that switch flips, Nvidia’s China ambitions remain on pause.