Despite varying inflation rates across member states and sluggish expansion, the European Central Bank keeps rates unchanged in a cautious, data‑driven move

In a decision closely watched across financial markets, the European Central Bank (ECB) opted to maintain its key interest rates unchanged this week, emphasising that while inflation has broadly approached its target, the divergence across the euro‑area remains significant and growth fragile. The move underscores the central bank’s balancing act between anchoring price stability and supporting a still‑subdued economy.

The ECB’s Governing Council opted for a data‑dependent, meeting‑by‑meeting approach rather than committing to further cuts or hiking in the near term, citing uncertainty stemming from uneven inflation dynamics and weak external demand.

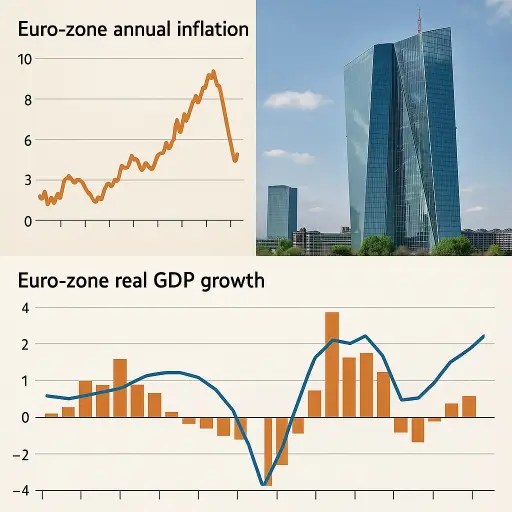

Inflation: Near target on average, but far from uniform

Average euro‑area headline inflation is now hovering close to the ECB’s medium‑term objective of around 2 percent, but this aggregate figure masks important variation. Some countries are seeing stronger service price growth or persistent energy transition‑cost effects, while others are drifting toward much lower inflation. That divergence limits the scope for a uniform policy shift.

Consumer expectations also reflect this mixed picture: household inflation expectations for the next year held steady around 2.7 percent in September, with longer‑term expectations anchored at about 2.2‑2.5 percent. Given this backdrop, the ECB judged that holding rates for now is prudent: inflation is no longer broadly accelerating, yet it is too unstable across regions to risk loosening prematurely.

Weak growth keeps policymakers cautious

While inflation has moved into the targeted range on average, growth in the euro‑zone remains modest at best. The ECB’s projections for the area show real GDP growth of 1.2 percent in 2025 but only 1.0 percent in 2026. External demand is weakening and global trade headwinds continue to weigh. Economic resilience has surprised on the upside: recent commentary from ECB officials highlight that growth has held around potential despite uncertainties. Yet the bank remains vigilant: that weak expansion limits its room to move aggressively in either direction.

Policy stance: On hold, for now

Given the combined inflation and growth outlook, the ECB decided to keep its key interest rates unchanged. This stance reflects a recognition that the monetary policy tightness has already done much of the heavy lifting, while allowing time to observe how price pressures evolve across individual countries.

Policymakers emphasised that they remain “in a good place” but made clear that the door remains open both to further reductions or a return to hikes if inflation surprises. The guiding mantra is “meeting‑by‑meeting, data‑dependent.”

Key risks ahead

- Inflation undershoot – If inflation falls significantly below target and remains weak due to growth drag, the ECB could be forced into cutting rates to avoid deflationary risks.

- Inflation rebound – If energy or wage pressures flare up, especially in countries where inflation is still elevated, the policy path could shift toward tightening.

- Growth shocks – A sharper‑than‑expected slowdown in Europe or globally (e.g., via trade or geopolitical shocks) might prompt a loosening of policy.

- Divergence intensifies – If inflation paths diverge further across member states, the challenge of a unified policy becomes more pronounced and may require more nuanced communication or targeted measures.

Implications for borrowers and savers

For households and businesses in the euro‑zone, the rate pause signals a continuation of the current borrowing cost environment without immediate relief or tightening. Those with variable‑rate debt should prepare for limited near‑term change. Savers may not expect improved deposit returns just yet, while investors in fixed income may continue to eyeball developments in inflation and growth before repositioning.

Looking ahead

With its next formal rate decision still weeks away, the ECB will focus on incoming inflation prints, labour‑market data, wage growth, and external demand indicators. Any signs of inflation veering off course or growth faltering unexpectedly will move the needle. For now, the pause reinforces a cautious stance in the face of uneven economic terrain.

In sum: the ECB has elected to hold rates steady in the present climate of modest inflation near target, but significant heterogeneity within the euro‑zone, combined with low growth, means navigating forward will require nimble decision‑making. The policy lock‑in might be temporary—but for now, the message is calm, patient, and watchful.