Washington seeks carve-outs for American LNG as Brussels tightens climate reporting, testing the balance between trade, security, and credibility

By late December, a quiet but consequential dispute has moved to the center of transatlantic relations: the United States is pressing the European Union to exempt American natural gas from parts of the bloc’s methane-emissions reporting regime. What Washington frames as a pragmatic adjustment to protect energy security, Brussels sees as a challenge to the integrity of its climate law — and to the principle that rules apply equally to all.

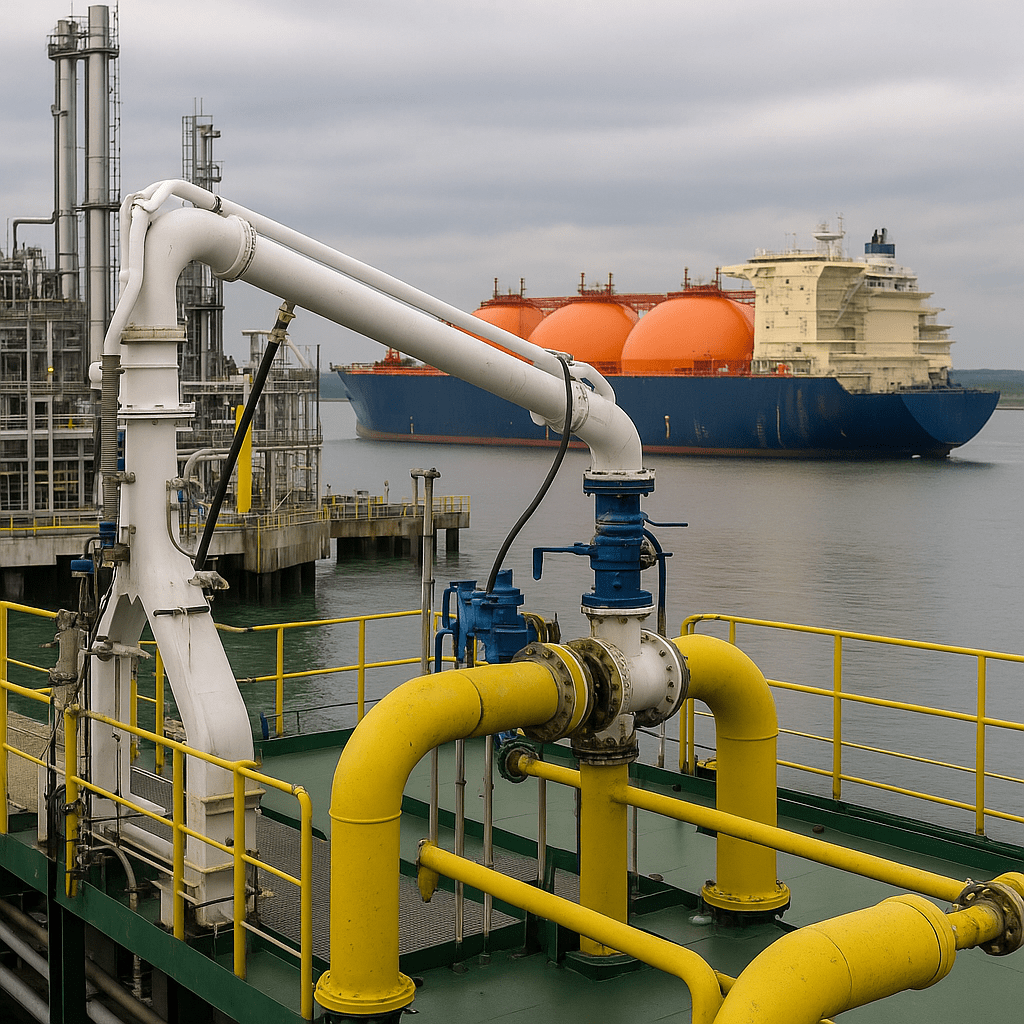

The disagreement has sharpened as Europe continues to rely heavily on liquefied natural gas shipped from the United States. Since the reshaping of global energy flows earlier in the decade, U.S. LNG has become a cornerstone of Europe’s gas supply, helping to stabilize markets and reduce dependence on single suppliers. That dependence now gives Washington leverage — and it is using it.

At issue is the EU’s methane regulation, a key plank of the bloc’s climate architecture. The law requires gas producers and exporters to monitor, report, and verify methane emissions across the supply chain. Methane, a potent greenhouse gas, has become a primary target for policymakers seeking rapid climate gains. The EU argues that transparency and accountability are essential if gas is to play any role during the energy transition.

U.S. officials counter that American producers already operate under a dense patchwork of federal and state rules, voluntary industry standards, and corporate disclosures. Imposing EU-style reporting, they say, would duplicate requirements, expose commercially sensitive data, and penalize exporters that are, on average, cleaner than many global competitors. In private meetings, U.S. negotiators have urged Brussels to recognize “equivalence” — accepting U.S. systems as meeting EU goals without forcing identical compliance.

European regulators are not convinced. For them, equivalence without full verification risks creating loopholes that could undermine the regulation before it is fully implemented. Several EU officials argue that exemptions for U.S. gas would invite demands from other suppliers, weakening the bloc’s leverage to push global standards upward. “If the largest exporter gets a pass,” one diplomat noted, “the rule stops being a rule.”

The clash exposes a deeper tension in the transatlantic climate partnership. On paper, Washington and Brussels present a united front on emissions reduction, methane pledges, and clean-energy investment. In practice, trade interests and domestic politics frequently intrude. U.S. lawmakers from gas-producing states have warned that burdensome EU rules could hurt exports and jobs, while European politicians face pressure from voters and environmental groups to ensure that imported energy does not dilute the bloc’s climate ambitions.

Industry sits uneasily in the middle. Major U.S. LNG exporters stress that they want access to the European market and recognize the political direction of travel. Many have invested in methane monitoring technologies and third-party certification. Yet they argue that aligning with EU law would require reconfiguring data systems and supply contracts across multiple jurisdictions — a costly exercise with uncertain payoff.

For environmental advocates, the dispute is a test of credibility. They warn that carving out exemptions for “friendly” suppliers sends the wrong signal at a time when methane reductions are among the fastest ways to slow near-term warming. Some groups accuse both sides of climate hypocrisy: Europe for prioritizing supply security over standards, and the United States for promoting gas abroad while tightening rules at home.

The outcome will likely hinge on compromise. One option under discussion is a phased approach, giving U.S. exporters more time to adapt while committing them to eventual alignment. Another is a narrowly defined equivalence framework, limited to specific reporting elements rather than a blanket exemption. Whatever the solution, it will set a precedent for how the EU treats energy imports in a decarbonizing world.

As the year draws to a close, neither side appears eager to escalate the dispute publicly. But the stakes are clear. For Washington, securing exemptions would protect a lucrative export market and reinforce its role as Europe’s energy partner of choice. For Brussels, holding the line is about more than methane metrics; it is about whether climate law can withstand geopolitical pressure.

The methane debate underscores a simple reality of the energy transition: even among allies, climate ambition collides with economic interest. How the United States and the European Union resolve this clash will signal whether transatlantic cooperation can move beyond shared rhetoric to shared rules.