After a strong multi-session advance, stocks across the continent catch their breath as investors weigh economic signals, central bank cues, and global uncertainties.

European shares steadied after a robust rally, as investors paused to assess a dense flow of economic indicators and shifting global dynamics. The mood across regional exchanges was mixed, reflecting a market that has moved quickly higher and is now recalibrating expectations rather than reversing course.

The recent advance had been fueled by renewed confidence that Europe’s economic slowdown may be bottoming out, alongside optimism that monetary policy is approaching a more predictable phase. That momentum carried major indices to fresh short-term highs, drawing in both institutional and retail investors. As the week progressed, however, traders appeared increasingly selective, locking in profits in sectors that had led the rally while rotating into more defensive pockets of the market.

Market participants described the pause as a natural consolidation. “This is not a risk-off moment so much as a reality check,” said one portfolio manager at a large continental asset manager. “After several days of gains, investors want confirmation that the macro story can justify the valuations they are now paying.”

Economic data released across the euro area offered a nuanced picture. Surveys of business activity pointed to stabilization in manufacturing, long a weak spot, while services continued to show resilience. At the same time, consumer sentiment indicators suggested households remain cautious, constrained by still-elevated living costs and uncertainty over income growth. The result was a market response that lacked a single clear direction, with stock pickers focusing on company-specific fundamentals rather than broad macro trades.

Central banks remained firmly in view. While policymakers have emphasized a data-dependent approach, investors are increasingly sensitive to any signal that could alter expectations for the policy outlook. Recent comments from officials reinforced the idea that progress on inflation is being made, but not without setbacks. This balance between optimism and caution was reflected in bond markets, where yields moved within narrow ranges, offering little additional guidance to equity investors.

Sector performance told a story of rotation rather than retreat. Financial stocks, which had benefited from improved confidence in economic activity, traded unevenly as investors weighed the outlook for lending growth against the prospect of tighter margins. Industrials, another recent outperformer, paused as markets digested fresh order data and global trade developments. By contrast, healthcare and consumer staples found modest support, appealing to investors seeking earnings stability amid lingering uncertainty.

Energy shares were influenced by movements in commodity markets, where prices fluctuated on geopolitical considerations and expectations around global demand. While the sector did not drive the broader market, it contributed to the overall sense of hesitation, with traders reluctant to make bold bets ahead of clearer signals from the global economy.

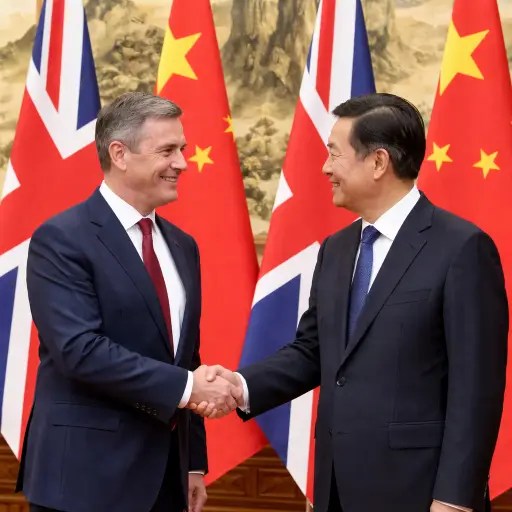

Beyond Europe, international factors continued to shape sentiment. Developments in the United States, particularly around growth momentum and policy guidance, remained a key reference point. Asian markets offered a mixed lead, with investors there also grappling with uneven data and policy signals. The interconnected nature of global markets meant that European investors were keenly aware of risks and opportunities beyond their own borders.

Corporate earnings added another layer of complexity. As reporting season gained pace, results generally met expectations, but forward guidance was closely scrutinized. Companies that struck a confident tone about demand and cost pressures were rewarded, while those that flagged uncertainty saw their shares lag. This emphasis on outlook rather than past performance underscored a market that is looking ahead, attempting to gauge how the remainder of the year might unfold.

Volatility remained relatively contained, suggesting that investors are not bracing for abrupt shocks but are instead adjusting positions incrementally. Trading volumes eased compared with the peak of the rally, reinforcing the impression of a market taking stock rather than changing direction. Analysts noted that such pauses often serve to strengthen trends, allowing new information to be absorbed before the next move.

Strategists cautioned against overinterpreting the day’s lack of momentum. “When markets rally hard, they need time to digest,” said an equity strategist at a European investment bank. “The underlying narrative has not shifted dramatically, but confidence is being tested by each new data point.”

Looking ahead, attention is set to remain firmly on economic releases and policy communication. Investors are keen to see evidence that growth can improve without reigniting inflationary pressures, a balance that would support equities while keeping financial conditions manageable. Any deviation from that path could quickly alter sentiment, particularly given the gains already logged.

For now, the leveling off in European shares appears less like a warning sign and more like a pause for breath. After a period of rapid ascent, markets are reassessing the landscape, weighing hope against caution. Whether the next move is higher or sideways will depend on how convincingly incoming data can support the optimistic assumptions that have driven the recent rally.

As the end of the month approaches, portfolio managers are expected to remain disciplined, favoring quality balance sheets and clear earnings visibility. In that sense, the current standstill may prove constructive, offering investors a moment to recalibrate before the next chapter in Europe’s market story unfolds.