Concerns Emerge Over Neutrality as CK Hutchison and MSC Expand Control in Central America

In an exclusive development with significant geopolitical and commercial implications, the head of the Panama Canal Authority has issued a stark warning regarding a $23 billion global ports deal between Hong Kong-based CK Hutchison Holdings and Swiss shipping giant MSC (Mediterranean Shipping Company). The transaction, which includes the acquisition of two key port facilities in Panama, has sparked concerns over the potential erosion of the canal’s long-standing neutrality mandate.

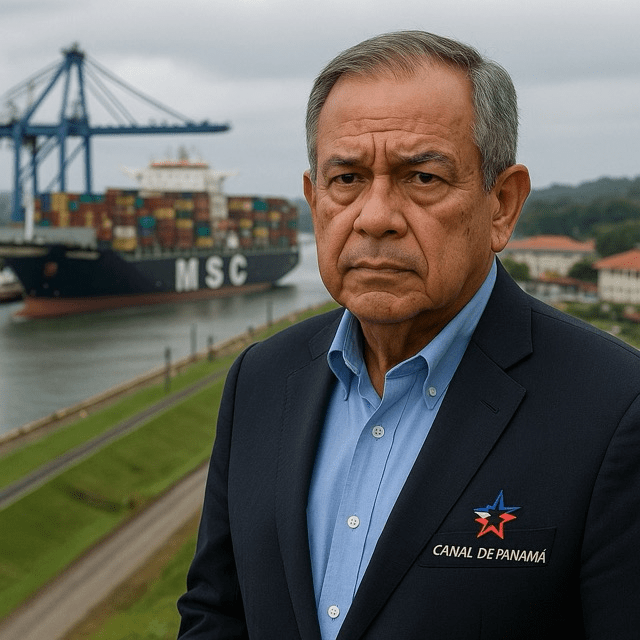

Ricaurte Vásquez Morales, the administrator of the Panama Canal Authority, said the concentration of port ownership by a few global players—particularly in a region as strategically vital as Central America—could create operational imbalances and ultimately disadvantage other shipping companies. “The canal must remain an even playing field for all maritime traffic,” he stated. “Any perception or reality of preferential treatment threatens the core principle of neutrality that underpins our governance…

The deal, finalized earlier this year, grants CK Hutchison and MSC joint operational control over port terminals in Colón and Balboa—two of the most critical logistics hubs flanking either end of the Panama Canal. Both companies have described the agreement as a means of increasing efficiency, improving container flow, and enhancing global supply chain resilience. However, critics argue that such consolidation gives the newly formed alliance outsized influence over shipping routes that directly interface …

Industry observers note that both CK Hutchison and MSC are among the largest players in the global shipping and logistics market. Their combined reach now spans more than 100 ports worldwide, prompting fears of monopolistic tendencies and restricted access for smaller, independent carriers. Analysts warn that these dynamics could lead to increased shipping costs and logistical bottlenecks—particularly for cargoes not aligned with the major operators.

The Panama Canal, which handles roughly 5% of global maritime trade, has historically operated under principles of political neutrality and commercial impartiality, enshrined in both domestic and international agreements. Any erosion of this perception could invite political tensions and impact the canal’s credibility as a vital conduit between the Atlantic and Pacific Oceans.

In response to these developments, the Panama Canal Authority is reportedly exploring legal and regulatory avenues to ensure compliance with its neutrality charter. Options include the introduction of oversight mechanisms, transparency rules for port operations, and stipulations that prevent discriminatory pricing or scheduling practices.

The Panamanian government, while supportive of foreign investment, has also indicated it will closely review the terms of the port deal. Officials are expected to hold talks with both CK Hutchison and MSC to ensure alignment with national interests and international trade obligations.

The controversy surrounding the deal reflects a broader trend of strategic competition in global port infrastructure. As countries and corporations vie for influence over chokepoints and logistics corridors, the risks of political entanglement and market distortion are increasingly evident. From the Suez Canal to the Strait of Malacca, similar concerns are emerging as major players seek to dominate the gateways of global trade.

For now, the Panama Canal remains operationally independent, but the debate over its neutrality is far from over. As the maritime industry watches closely, the outcome of this high-stakes infrastructure saga may shape the rules of engagement for port ownership and global logistics for years to come.