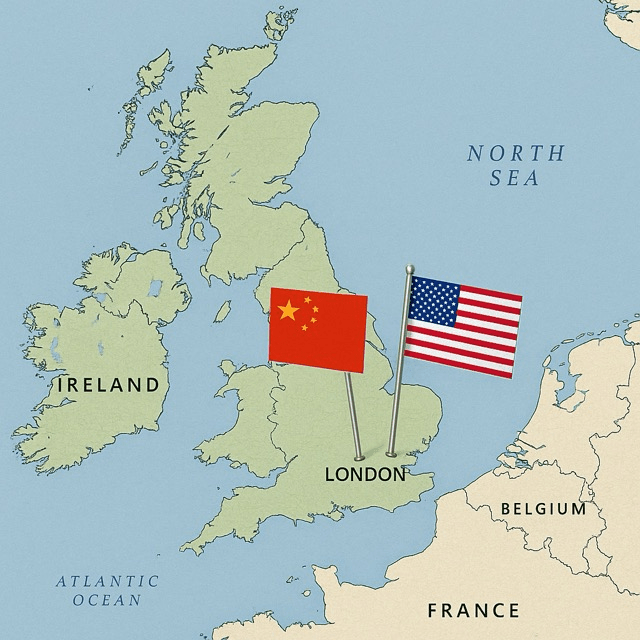

Diplomatic delegations from the U.S. and China meet in London to seek common ground on tariffs, technology, and global market stability

High-level trade negotiations between the United States and China resumed this week in London, with both nations sending senior delegations in a bid to de-escalate economic tensions and stabilize bilateral relations. The meetings, held at an undisclosed location in the British capital, mark the latest round of talks aimed at resolving ongoing disputes related to tariffs, technology transfers, and market access.

Leading the U.S. team is U.S. Trade Representative Katherine Tai, accompanied by senior advisors from the Department of Commerce and the White House National Economic Council. Representing China is Vice Premier Liu He, a key architect of China’s economic policy, along with officials from the Ministry of Commerce and China’s central bank. Both delegations have emphasized the importance of constructive dialogue amid rising global uncertainty.

The London setting provides a neutral ground for negotiations, away from domestic political pressures in Washington and Beijing. British officials have not participated directly in the talks but have reportedly facilitated the logistics to ensure a secure and discreet environment for discussions.

Topics under negotiation include the reduction of tariffs imposed during the U.S.-China trade war, the future of technology restrictions targeting Chinese firms, and commitments from both sides to uphold international trade norms. Sources close to the negotiations say that while no major breakthrough is expected immediately, the tone has been more pragmatic and less confrontational compared to previous sessions.

“The goal is to build momentum and restore predictability in our trade relationship,” one U.S. official noted. “We recognize the deep economic ties between our countries and the global impact of our decisions.”

Tensions between the two economic superpowers have remained high in recent years, exacerbated by disagreements over intellectual property rights, data security, and geopolitical flashpoints such as Taiwan and the South China Sea. However, with both economies facing slowing growth and mounting external pressures, there is renewed incentive on both sides to find areas of compromise.

Economic analysts suggest that even incremental progress could have significant effects on global markets. Wall Street and Asian stock exchanges have responded cautiously but positively to news of the London talks. Investors are particularly keen on any signals suggesting a rollback of punitive tariffs that have disrupted global supply chains.

In parallel, discussions are reportedly touching on broader cooperation in areas such as climate change, pandemic preparedness, and financial regulation. While these topics fall outside traditional trade boundaries, they reflect the complex interdependence between the U.S. and Chinese economies in today’s globalized landscape.

Despite the encouraging tone, obstacles remain. Domestic political factions in both countries are skeptical of concessions, and any agreement reached in London will require careful navigation through domestic legislative and regulatory hurdles.

As the week of talks continues, both sides have agreed to maintain a media blackout, releasing only brief statements reiterating their commitment to ongoing dialogue. Observers suggest that the success of the negotiations may ultimately be judged not by immediate outcomes, but by whether they pave the way for a long-term stabilization of U.S.-China economic relations.

In a world increasingly shaped by competition and interconnectivity, the outcome of these London negotiations could resonate far beyond the boardrooms and conference halls—impacting everything from global inflation rates to the future of emerging technologies.