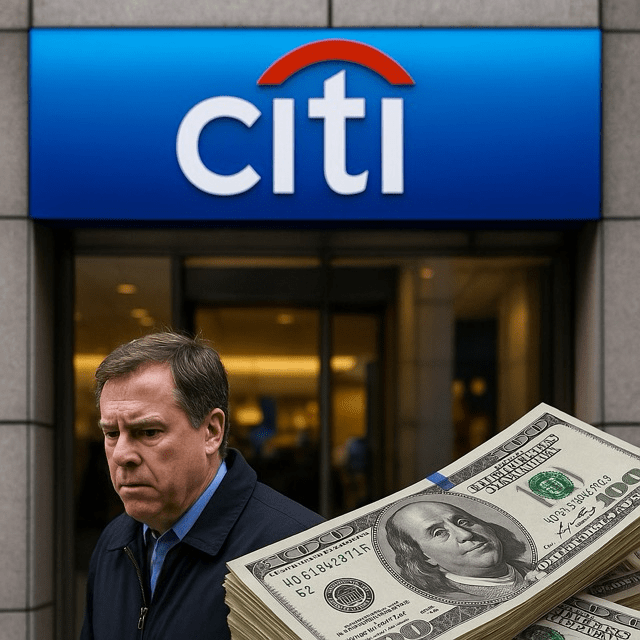

Bank set to boost bad loan provisions amid rising consumer and business financial stress

Citigroup, one of the largest financial institutions in the United States, is bracing for a potential wave of defaults by increasing its provisions for bad loans by several hundred million dollars. This move reflects a growing sense of financial vulnerability among both consumers and businesses, signaling potential turbulence in the broader economic landscape.

According to sources familiar with the matter, the bank is set to announce the increased provisions in its upcoming quarterly earnings report. This strategic financial buffer is designed to safeguard the bank against possible loan losses resulting from deteriorating credit conditions.

The increase in provisions comes as consumers face mounting challenges, including persistent inflation, higher interest rates, and declining savings. Many households are struggling to keep up with rising costs, particularly in housing, healthcare, and essential goods. As credit card delinquencies and personal loan defaults begin to rise, banks like Citigroup are taking proactive steps to manage the associated risks.

On the business side, companies—particularly small and mid-sized enterprises—are grappling with tighter credit conditions and reduced consumer demand. Sectors such as retail, hospitality, and manufacturing are experiencing slower growth or even contraction, increasing the likelihood of loan defaults.

Jane Fraser, CEO of Citigroup, has reiterated the bank’s commitment to prudent risk management and long-term stability. “We are closely monitoring economic developments and remain focused on supporting our clients while protecting the integrity of our balance sheet,” she said in a recent statement.

The move to boost loan loss reserves is not unique to Citigroup. Other major banks are expected to follow suit, as macroeconomic indicators continue to flash warning signs. The Federal Reserve’s recent signals about maintaining higher interest rates for an extended period have added further strain on borrowing costs, exacerbating existing financial pressures.

Industry analysts view Citigroup’s decision as a necessary step in light of current economic uncertainties. “It’s a sign of the times,” said one analyst. “Banks are recognizing that the economic environment is shifting, and they need to be prepared for what comes next.”

As the global economy navigates an increasingly complex landscape, financial institutions are once again called upon to balance growth with caution. For Citigroup, that means reinforcing its defenses in anticipation of potential headwinds—an approach that may well define the banking industry’s strategy in the months ahead.