A New Era for Energy Markets as Domestic Output Faces Unexpected Setback

For the first time since the height of the COVID-19 pandemic, U.S. oil production is expected to decline in the coming year, signaling a potential turning point in the nation’s energy sector. The drop, projected by both government agencies and private analysts, is being attributed to a combination of declining well productivity, reduced drilling investment, and growing pressure from environmental and market forces.

According to the U.S. Energy Information Administration (EIA), domestic crude oil output will dip modestly in 2025, breaking a trend of steady post-pandemic recovery that has seen American production approach record levels. Industry observers suggest this could be more than a temporary blip; it may reflect structural shifts in the sector.

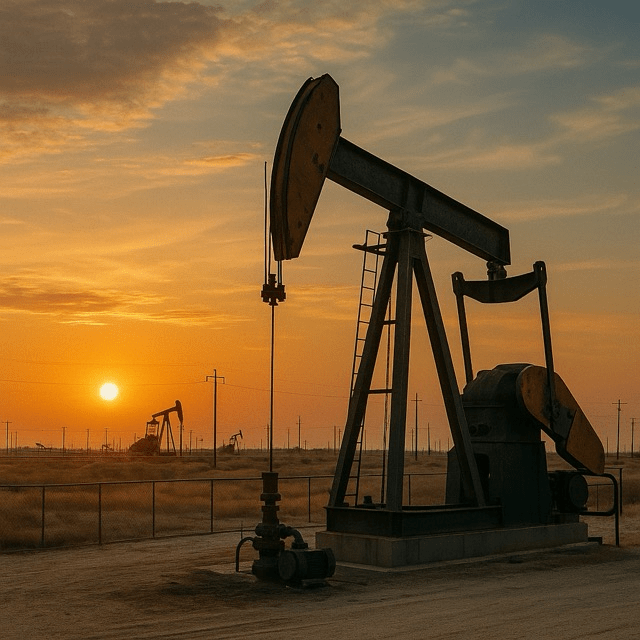

One of the primary reasons for the slowdown is declining output from existing shale wells. Many of the most productive fields, such as those in the Permian Basin, are beginning to show signs of maturation. As new well drilling slows, the overall productivity of U.S. oil fields is expected to taper off.

Compounding the issue is a recent pullback in capital expenditure by major oil companies. Facing global market uncertainty and a growing push toward renewable energy, many firms are reevaluating long-term investments in fossil fuels. The trend has been further fueled by rising borrowing costs, stricter regulations, and increased shareholder demand for dividends over drilling.

Environmental considerations are also playing a larger role. With climate change at the forefront of policy debates, the Biden administration has introduced new regulations on methane emissions and limited drilling on federal lands. These initiatives, while applauded by environmental groups, have introduced additional layers of compliance and cost for oil producers.

The international landscape further complicates matters. OPEC+ nations, particularly Saudi Arabia and Russia, continue to adjust their output in response to global demand, often in ways that disrupt U.S. market share and pricing power. As the world increasingly looks to diversify energy sources, America’s dominant role in global oil supply is being subtly but steadily challenged.

Yet, not all experts see the dip as a negative development. Some analysts argue that a moderate decline in production could lead to more sustainable operations and better financial health for the industry. Others suggest this may accelerate the shift toward cleaner energy, especially if investment dollars are redirected toward wind, solar, and battery storage infrastructure.

Still, the news has sent ripples through markets, raising questions about fuel prices, employment in oil-rich regions, and the broader geopolitical implications of reduced U.S. energy dominance. The next 12 to 18 months will be critical in determining whether this production drop is a temporary correction or the beginning of a long-term realignment.

As the world continues its energy transition, the U.S. faces a new chapter — one in which the balance between economic security, environmental responsibility, and energy independence must be more carefully managed than ever before.