Since 2018, financial institutions across Europe have spent heavily on severance packages to streamline leadership structures

European banks have collectively spent more than €1.1 billion since 2018 on severance and redundancy packages for senior executives as they restructure operations to remain competitive in an evolving financial landscape.

This massive outlay reflects a broader trend among financial institutions to trim top-heavy leadership structures, reduce costs, and adapt to new regulatory environments and digital disruption. As the traditional banking model comes under increasing pressure, many of Europe’s largest lenders have been forced to rethink their organizational design and eliminate high-cost management roles.

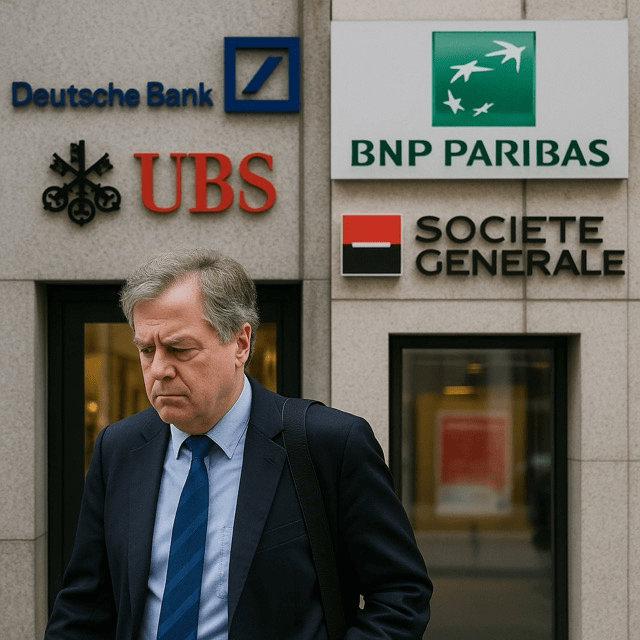

Leading banks such as Deutsche Bank, HSBC, Barclays, and Société Générale have spearheaded this trend, announcing widespread cuts to their senior ranks over the past few years. These measures are part of broader transformation strategies aimed at simplifying corporate hierarchies, increasing operational efficiency, and shifting focus toward more agile, tech-driven business models.

Industry analysts argue that while the short-term costs of these cuts are significant, the long-term savings and operational improvements are expected to outweigh the initial expenditure. Senior staff reductions often come with substantial severance packages, pensions, and other exit compensations, which account for the high total cost.

Deutsche Bank, for instance, has spent hundreds of millions of euros on its restructuring efforts, which have included axing thousands of positions across multiple levels. Similarly, HSBC’s strategic pivot toward Asia involved significant staff reductions in Europe, impacting many senior leaders.

This shift is not just about cost-cutting—it also reflects changing skill requirements within the banking sector. Today’s financial institutions demand leaders with deep technological expertise, agility in decision-making, and the ability to drive digital transformation. As a result, traditional leadership profiles are being replaced by new talent aligned with the future of banking.

However, these changes have not been without controversy. Unions and industry watchdogs have raised concerns over governance, transparency, and the human cost of sweeping layoffs. Critics argue that cutting senior staff en masse can lead to instability, morale issues, and the loss of institutional knowledge, which could harm long-term strategic execution.

Nevertheless, the trend shows no signs of slowing. As macroeconomic uncertainties persist and competition from fintechs intensifies, European banks are expected to continue streamlining leadership and refining their operational models.

In a rapidly evolving financial ecosystem, shedding legacy costs and embracing innovation are seen as crucial survival strategies. The €1.1 billion price tag attached to leadership downsizing highlights just how seriously the banking sector is taking this transformation challenge.