After calling for the Intel chief’s resignation last week, the White House pivots to engagement, saying it will spend time with the CEO to bring ‘suggestions’ on how Washington can help the chipmaker.

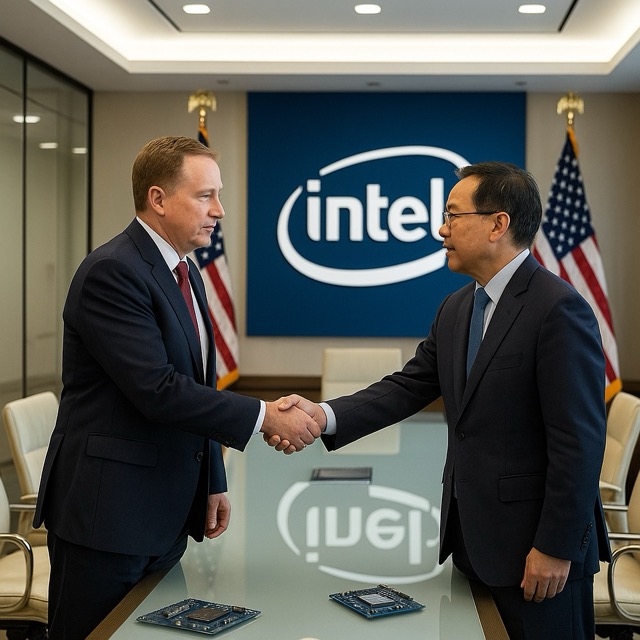

SANTA CLARA / WASHINGTON – Less than a week after demanding he step down, President Donald Trump has signaled he is open to working with Intel chief executive Lip‑Bu Tan — a sharp turn that calmed markets and offered a lifeline to one of America’s most storied technology companies.C

In posts on Truth Social after a Monday White House meeting, Trump called the session with Tan “very interesting,” praised the Malaysian‑born executive’s “amazing” career, and said members of his cabinet would spend time with the Intel boss over the next week and “bring suggestions” to the president. Investors read that as a green light for talks about how Washington might assist Intel’s turnaround, from permitting and procurement to the cadence of federal subsidies under the CHIPS and Science Act.

The shift marks a dramatic reversal from last Thursday, when Trump publicly declared that Tan was “highly CONFLICTED” and “must resign, immediately.” The attack followed a letter from Senator Tom Cotton questioning the executive’s past investments in Chinese technology companies. Reuters previously reported that Tan, through his funds, had invested heavily in hundreds of Chinese manufacturing and chip ventures, some later identified by analysts as suppliers to the People’s Liberation Army. Intel and Tan say accusations about conflicts are based on misinformation and that the CEO has always operated within legal and ethical bounds.

Intel issued a conciliatory statement after Monday’s meeting, calling the discussion “candid and constructive” and stressing the company’s role in U.S. technology and manufacturing leadership. In an open letter to employees last week, Tan wrote that his team is “engaging with the Administration to address the matters that have been raised and ensure they have the facts,” adding that the board is fully supportive of the company’s strategy.

Wall Street, rattled by the prospect of a leadership crisis at a company central to U.S. industrial policy, welcomed the thaw. Intel shares climbed roughly 4% on Monday and extended gains in after‑hours trading as investors bet that a running battle with the White House was less likely. Analysts said the president’s about‑face lowers the odds of fresh restrictions on Intel’s access to federal programs or government contracts — though it does not eliminate policy risk.

The practical question now is what “help” might look like. People familiar with the talks describe a menu that ranges from mundane, fast‑tracked permits and power hookups at new fabs, to a steadier schedule for disbursing previously announced CHIPS funding. Intel has been one of the largest recipients of awards under the 2022 law, with multibillion‑dollar support to expand manufacturing in Ohio and Arizona. Procurement is another lever: Defense and civilian agencies can place longer‑term orders for trusted‑foundry services and specialty chips, improving factory utilization.

None of that would constitute a bailout. Even before Tan’s appointment in March, Intel had outlined a plan to cut costs, sell non‑core assets and refocus on manufacturing discipline after years of missed technology milestones. The company is attempting to ramp the most advanced U.S. process technology later this year while tightening capital spending on projects that no longer fit its timetable. Government help — if it materializes — would function more like scaffolding around an ongoing rebuild.

Politically, the pivot buys time for both sides. Trump can claim he is defending national and economic security while remaining open to solutions that protect jobs and U.S. manufacturing. The White House also avoids the market fallout that a forced ouster could have ignited. For Tan, engagement with the administration defuses immediate pressure while he tries to steady operations and win support from skeptical investors.

The flashpoint underscores how deeply the chip industry is entangled with geopolitics. Washington’s export controls and investment‑screening regimes have tightened in recent years, and both parties describe semiconductors as a strategic sector. Even so, personal relationships between CEOs and presidents now appear to carry outsized weight. That dynamic has critics: business groups warn that leader‑by‑leader bargaining risks cronyism and leaves smaller firms without a voice, while some national‑security hawks say any outreach to Intel must come with strict guardrails on technology transfers and China exposure.

Inside Intel, the episode has hardened the focus on execution. The company still trails Taiwan’s TSMC in cutting‑edge manufacturing and has limited presence in the fastest‑growing corner of the industry — artificial‑intelligence accelerators dominated by Nvidia. A smoother path with Washington could help remove peripheral distractions, but the heavy lifting remains on the factory floor: yield, throughput and on‑time delivery.

Investors will watch for three near‑term milestones. First, whether the administration clarifies any conditions on future CHIPS disbursements or agency procurement that would affect Intel’s cash flow. Second, the pace at which Intel brings its next manufacturing node into high‑volume production — a test of whether the company has finally broken its cycle of delays. Third, the outcome of discussions around any divestitures or partnerships aimed at sharpening Intel’s focus.

There are no guarantees the détente will hold. Trump’s tone can change quickly, and lawmakers who questioned Tan’s ties will keep up pressure for answers. The administration has also tied corporate support to broader policy goals, including domestic job creation, apprenticeship programs and “Buy American” provisions. Intel’s leaders say they are prepared to meet those tests, but warn that frequent policy swings make long‑horizon manufacturing bets harder to plan.

For workers in Ohio and Arizona — where Intel has major construction projects — the politics feel personal. Hiring plans depend on the sequencing of tool installs and customer commitments; delays ripple into local suppliers and training programs. Union and business‑group leaders say predictability is the real subsidy: explicit timelines for permits, power and water; clear export rules; and straightforward procurement contracts.

To the outside world, the image of a U.S. president publicly demanding a CEO’s resignation and then praising him days later will reverberate well beyond Silicon Valley. Allies and competitors alike will read the episode as a sign of how tightly U.S. industrial policy is now intertwined with the Oval Office — and how quickly that policy can shift. For the semiconductor sector, where product cycles run in years and fabs take a decade to plan, that volatility is itself a cost.

What comes next procedurally is modest but telling. Working‑level follow‑ups between Intel and the Departments of Commerce and Treasury are expected to crystallize into a short list of “asks” — items that the company says would accelerate U.S. manufacturing without bending rules. Any headline announcements would likely wait until there is progress on factory ramps or a broader understanding with allies on export controls. Meanwhile, Tan will be courting customers and investors with a message that the political storm is passing and that execution is back in the foreground.

For now, the market has its answer: the White House is not trying to blow up Intel’s turnaround — at least not this week. If Tan can translate a fraught week of politics into a steadier operating environment, the company may finally get the space it needs to prove that a U.S. chip giant can still make world‑class silicon on home soil.

Sources:

• Reuters — “Trump demands ‘highly conflicted’ Intel CEO resign over China ties,” Aug. 8, 2025.

• ABC News / AP — “Trump says Intel CEO has an ‘amazing story’ days after calling for his resignation,” Aug. 12, 2025.

• Investopedia — “Intel Stock Climbs as CEO Lip‑Bu Tan Meets With Trump After Calls for Resignation,” Aug. 11–12, 2025.

• Intel Newsroom — “My commitment to you and our company,” CEO Lip‑Bu Tan letter, Aug. 7, 2025.

• Financial Times — coverage of Trump softening stance on Intel boss after resignation demand, Aug. 12, 2025.